In this report, we present the quarterly review of the Global Fixed Income Strategy Model Bond Portfolio. The portfolio remains positioned for slower global growth momentum over the next 6-12 months, favoring government bonds over…

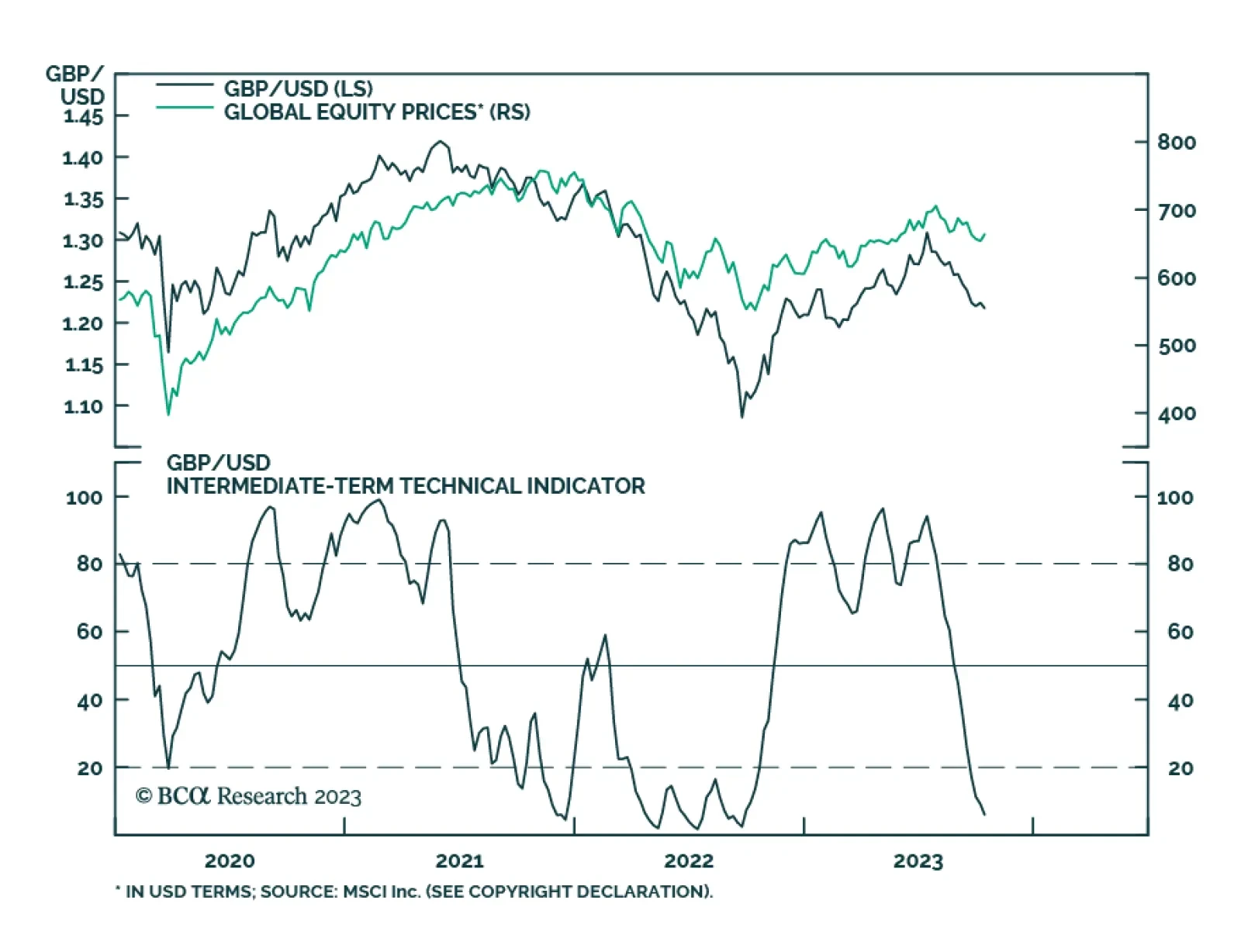

Back in May, our foreign exchange team suggested the risk to sterling was to the downside. Indeed, GBP/USD is down 8% from its recent peak. While dollar strength largely explains this move in GBP/USD, there have been other…

As expected, the UK economy bounced back in August with GDP expanding by 0.2% m/m following a 0.6% m/m decline in July. Yet to the extent that this improvement largely reflects a rebound after strikes weighed down on activity in…

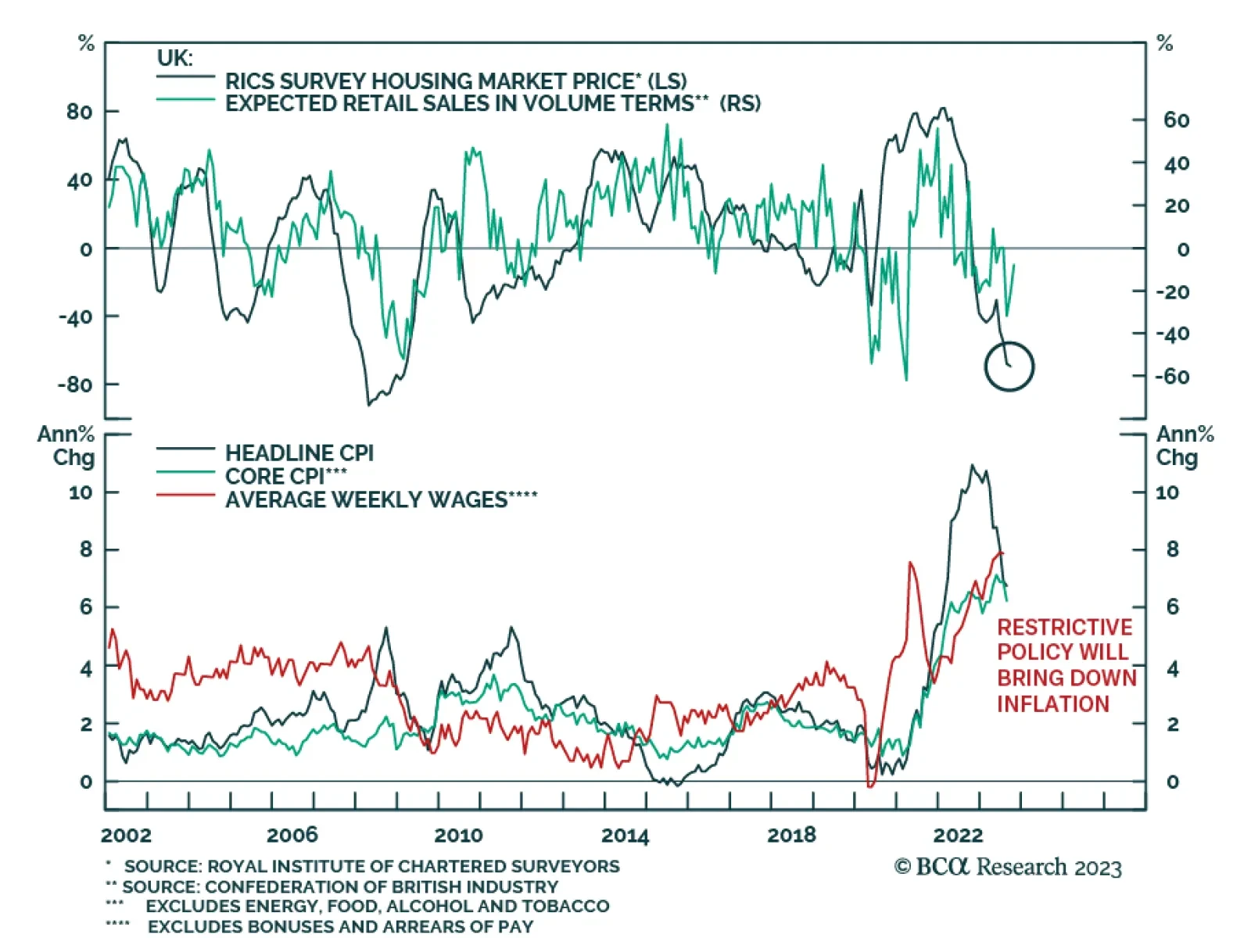

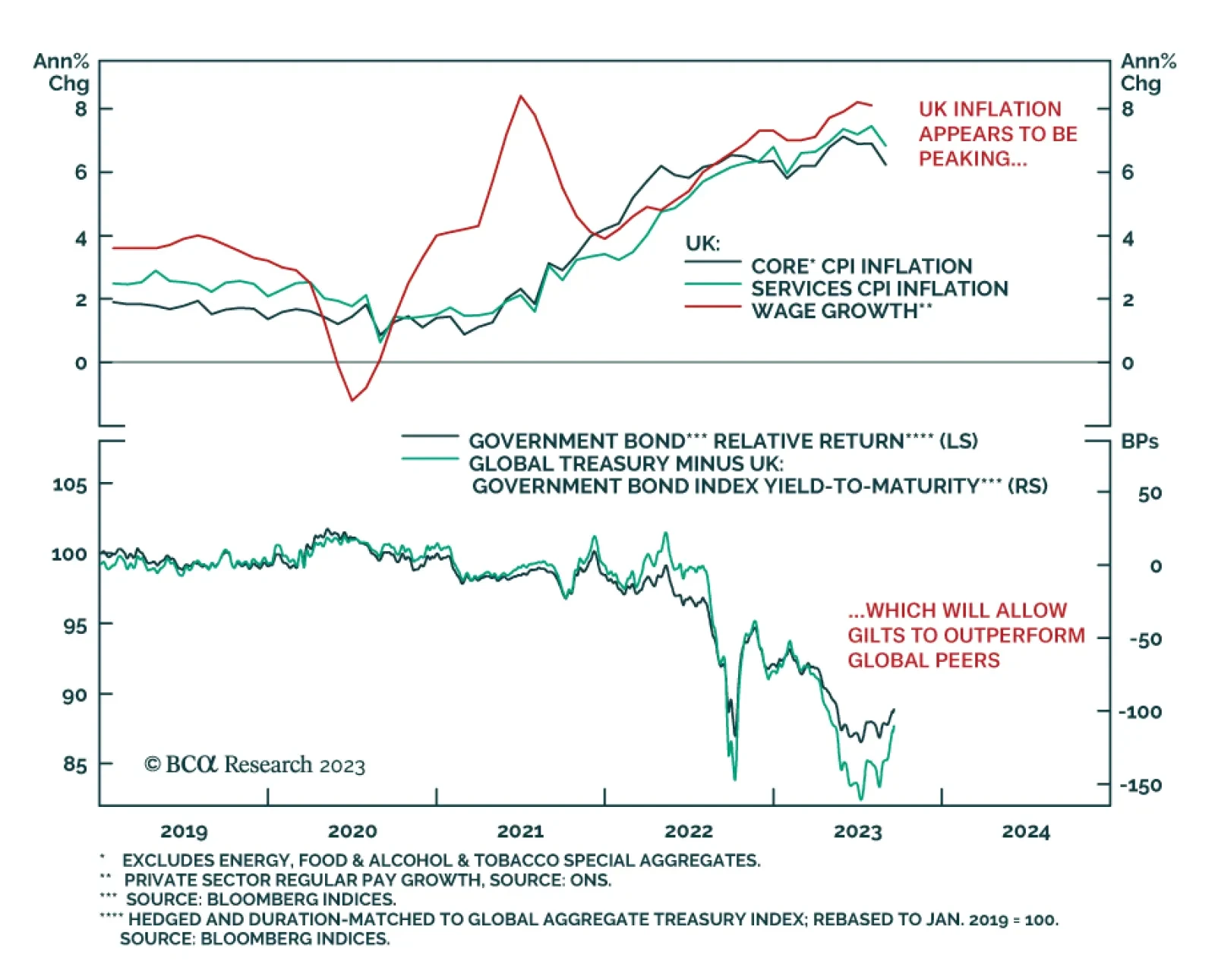

The results of the Bank of England’s latest monthly Decision Maker Panel survey reduces pressure on policymakers to tighten further. Business expectations regarding output price inflation over the coming year fell from 5…

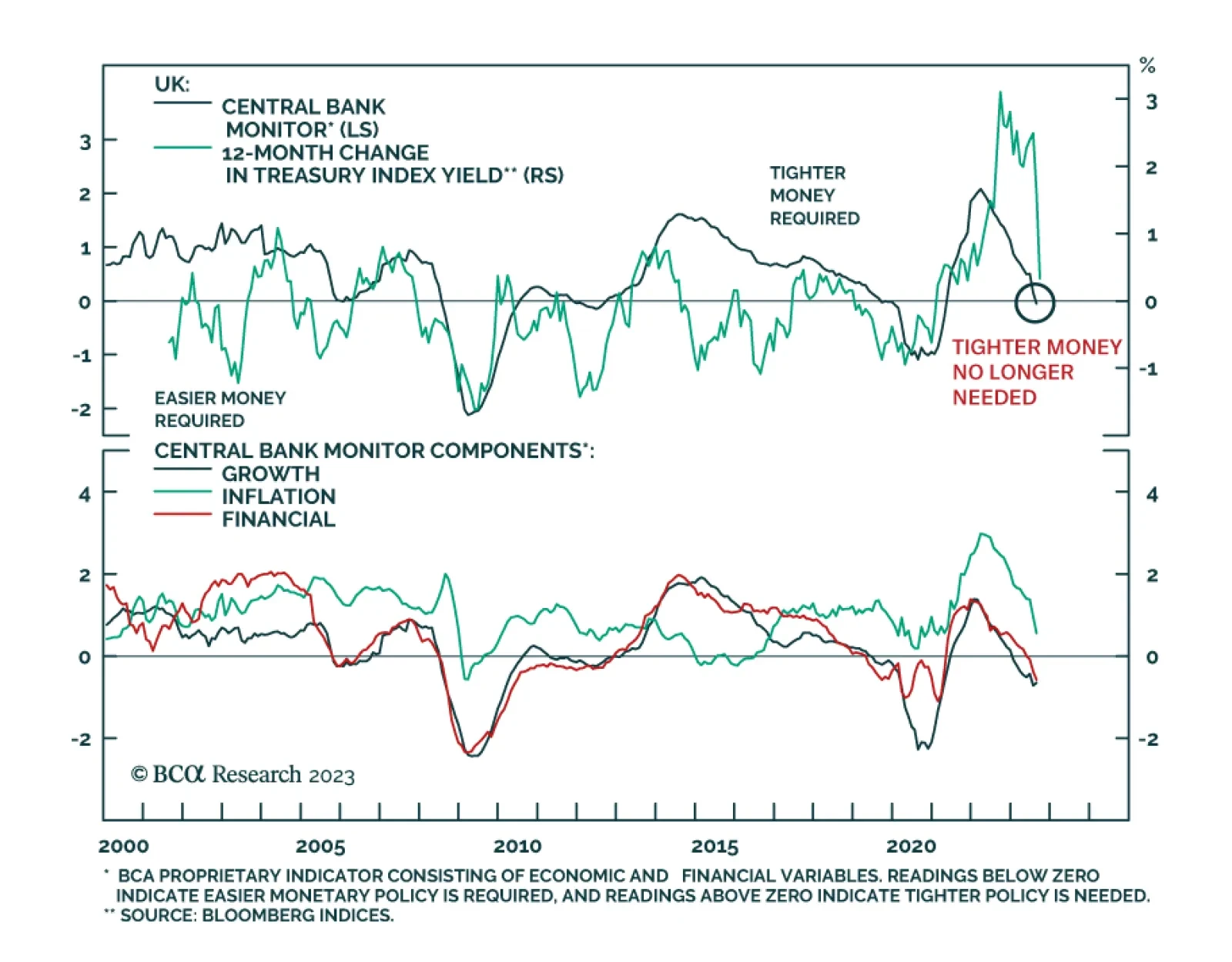

The Bank of England’s Monetary Policy Committee voted 5-4 in favor of maintaining its bank rate at 5.25% on Thursday. The four members that voted against the pause all preferred a 25-basis point rate increase. The tight…

The August UK inflation report produced a large downside surprise. Headline CPI rose +0.3% month-on-month, versus expectations of a +0.7% increase. Year-over-year headline CPI inflation slowed to 6.7% from 6.8%, a sizeable miss…

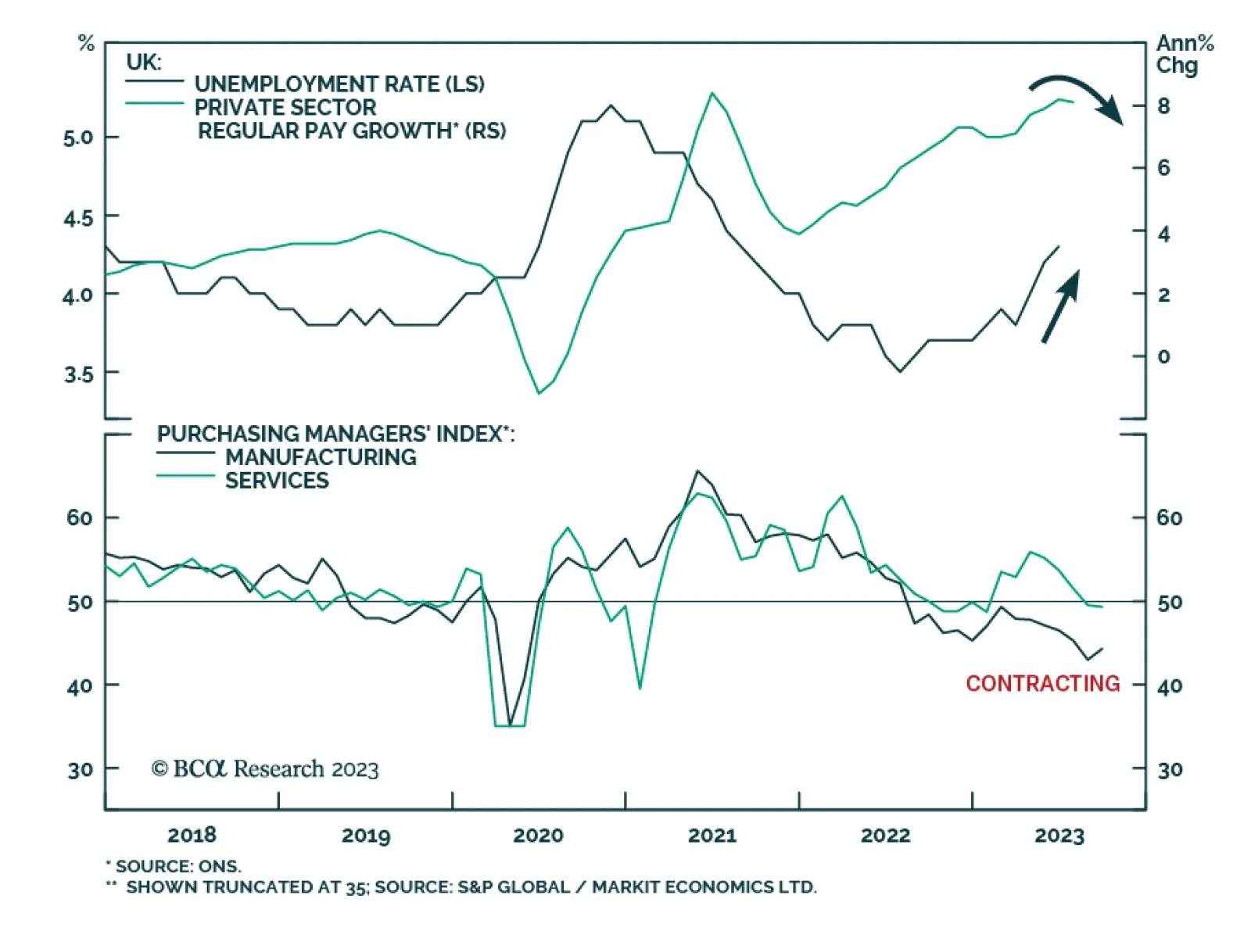

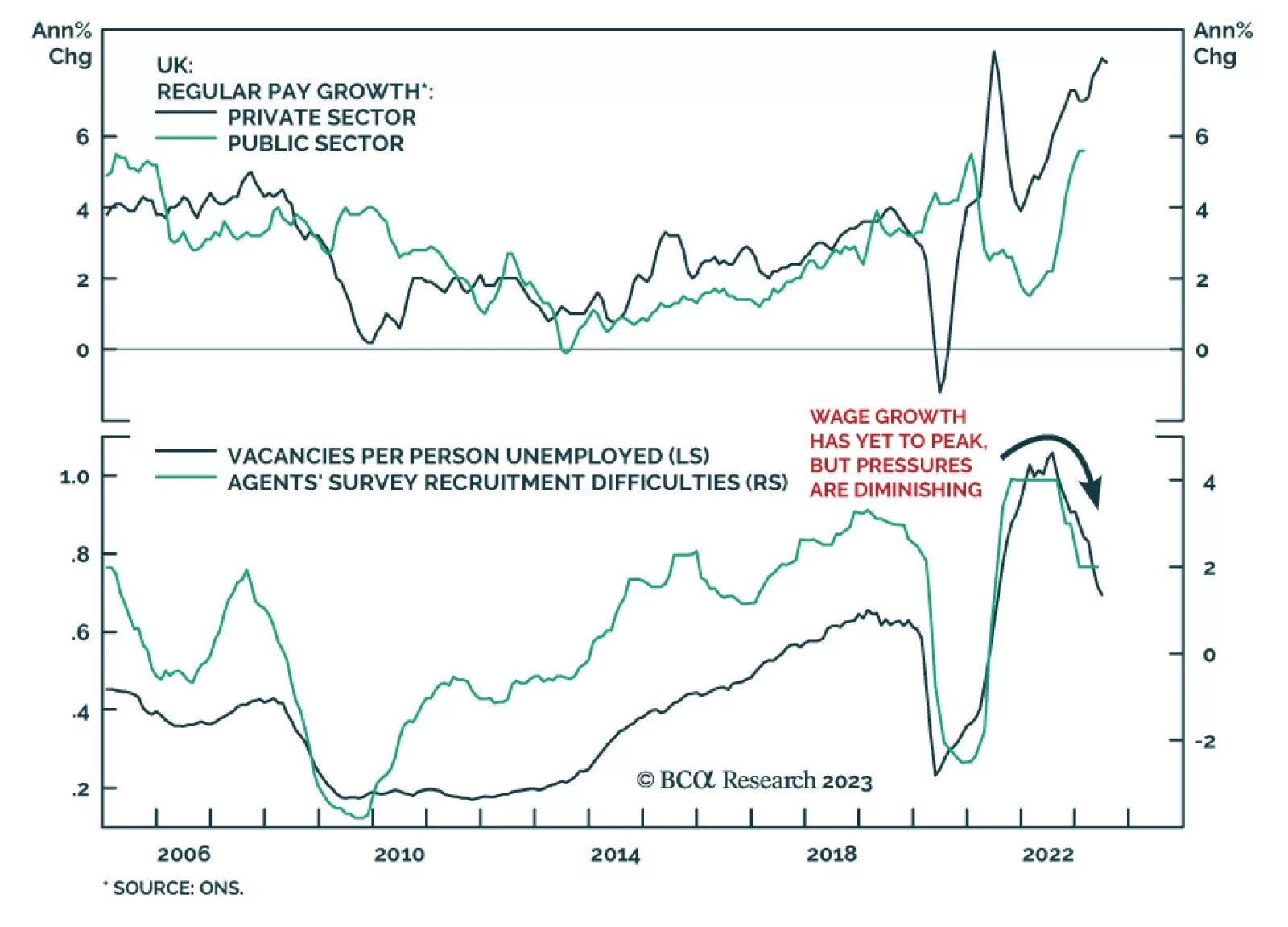

The latest UK labor market developments complicate the Bank of England’s task when it meets next week. The unemployment rate ticked up from 4.2% to 4.3% in the three months to July as employment fell by 207 thousand.…

In this report, we assess the best opportunities in inflation-linked bonds in the major developed economies, based on trends in growth, inflation and the stance of monetary policies in each country. We conclude that the environment…