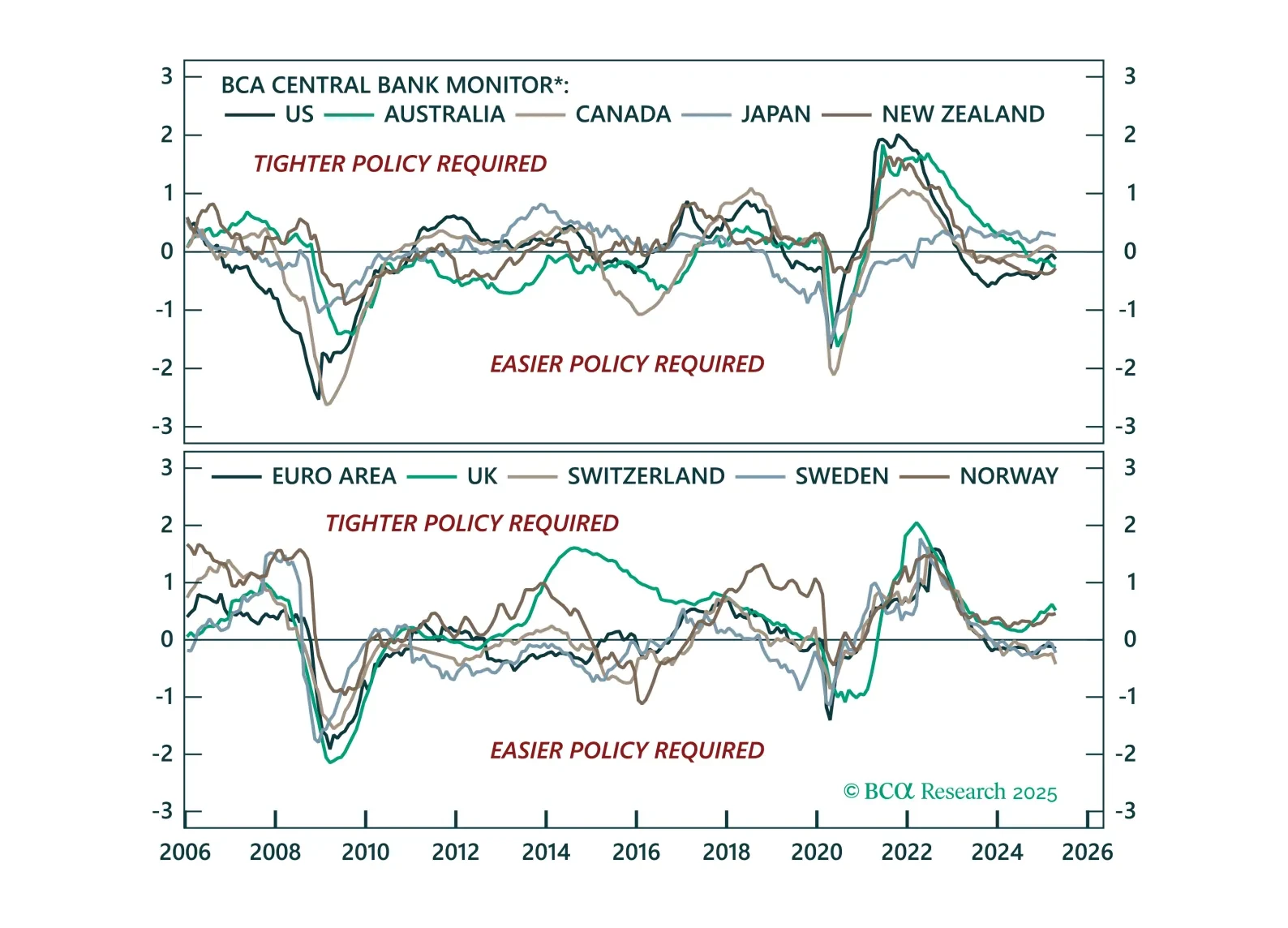

The easing bias remains, but not all central banks are equal. This Central Bank Monitor update reveals who is ready to cut more and who is still pretending not to.

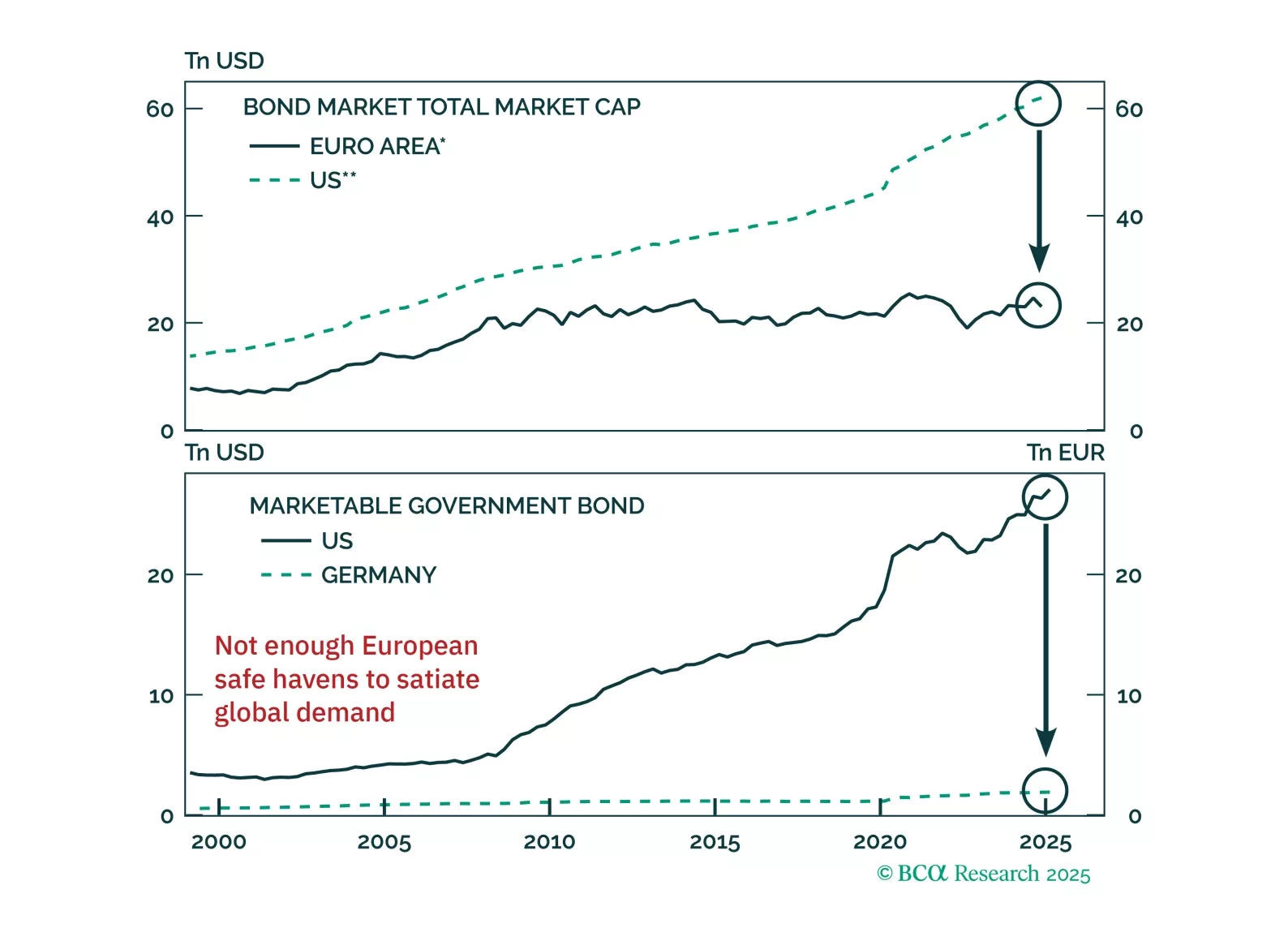

Our European Investment strategists maintain a defensive stance. Favor bunds as an emerging safe-haven complement to US Treasurys and a value tilt in equities. While the dollar and US fixed income remain the global anchor, EUR/USD…

Are bunds the new Treasurys? The euro and German debt are gaining favor as safe havens, but markets may be overplaying the shift. Our latest report dissects what's durable, what's not, and how to trade the dislocation.

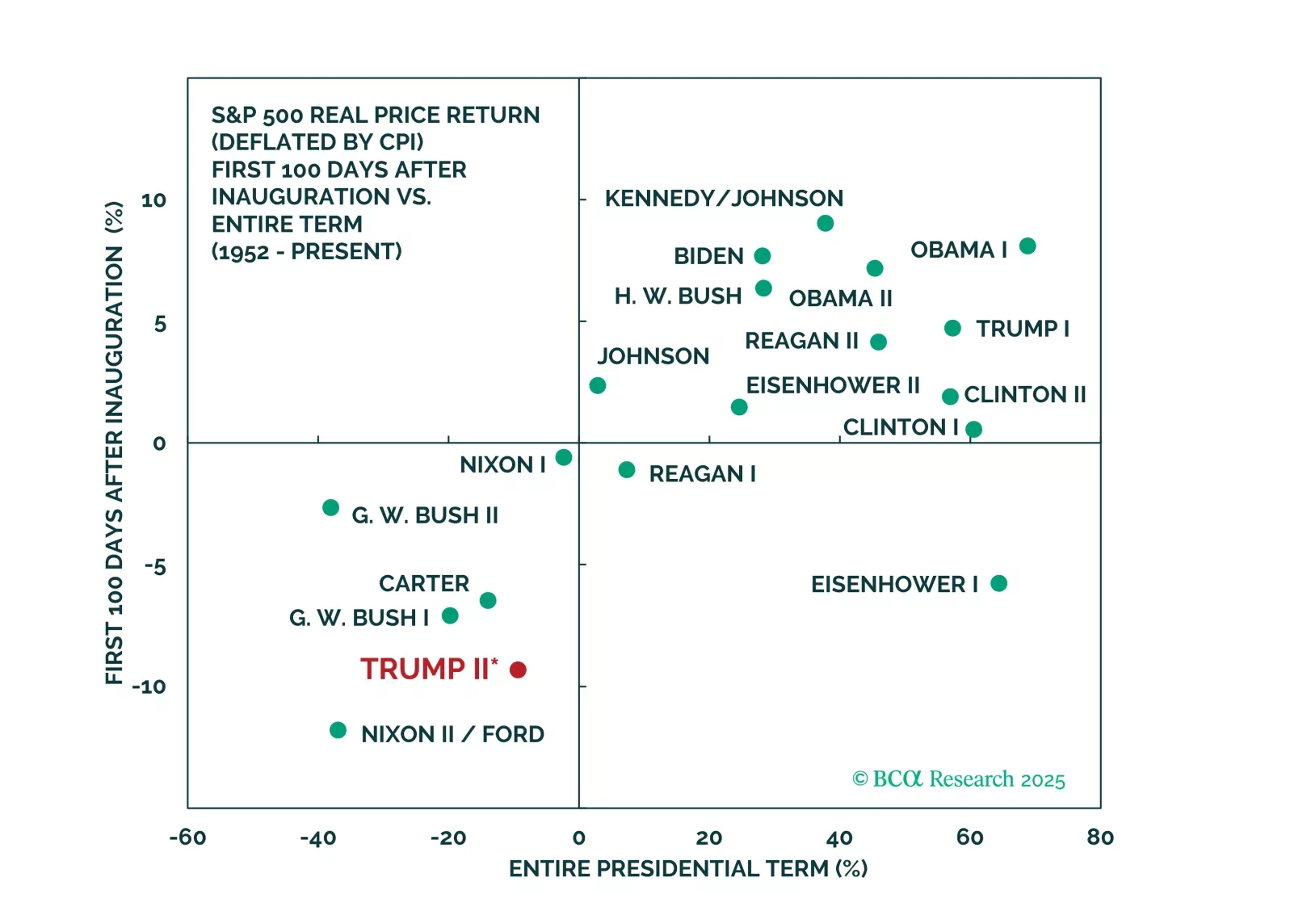

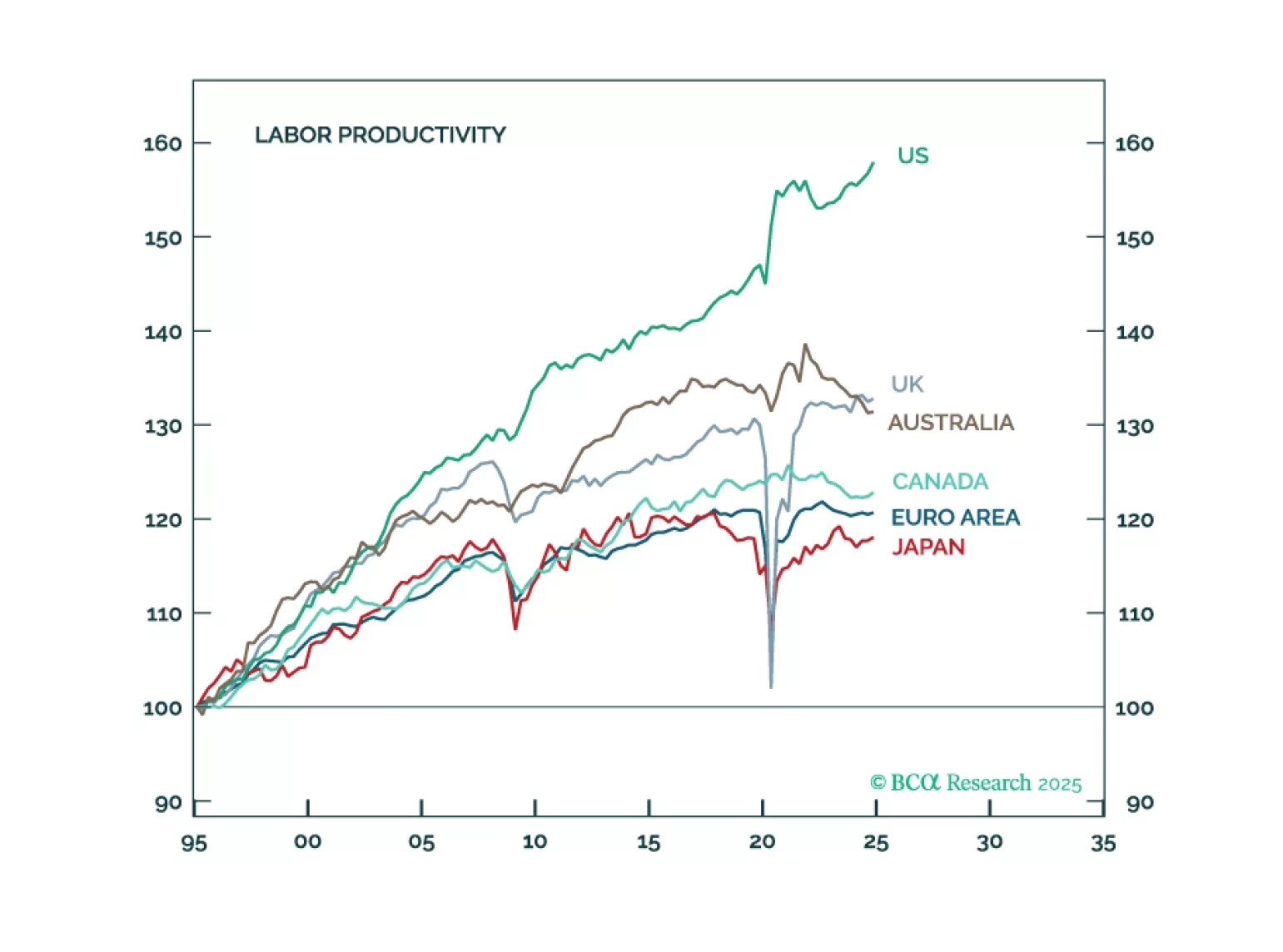

Although the sell-off in the US dollar and relative outperformance of non-US stocks will pause over the coming months as a global recession begins, the fading of US exceptionalism will still cause the dollar to weaken and US stocks…

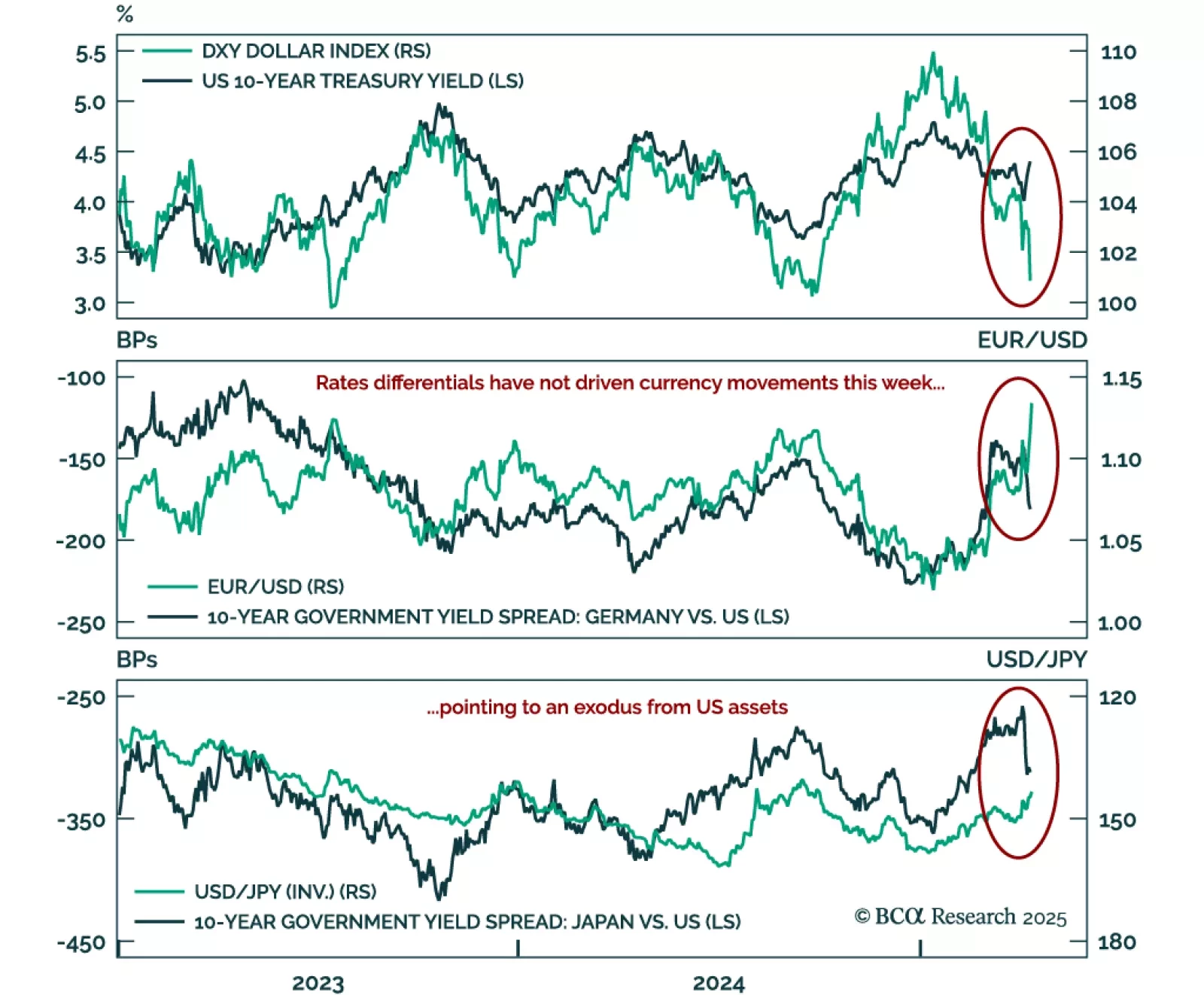

Bessenomics has failed so far. The key pillars of Bessent’s policy mix – achieving lower interest rates and robust economic growth – have been severely jeopardized. The US dollar has depreciated for different reasons than Bessent had…

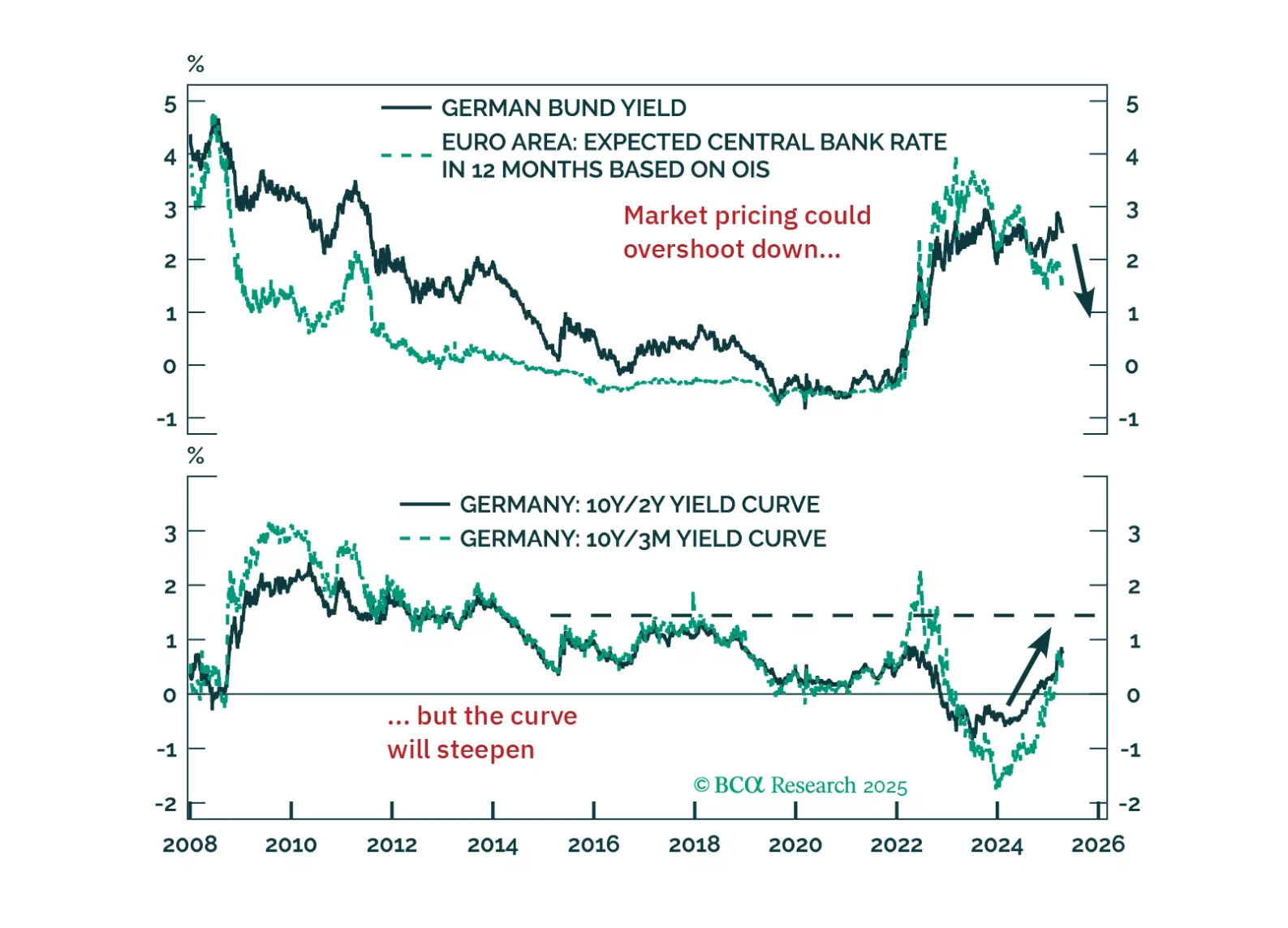

Europe’s deflation problem is getting harder to ignore. This week’s ECB cut is just the beginning — tariffs, the euro’s rally, and softening demand all point to more easing ahead. We explain what it means for yields, equities, and…

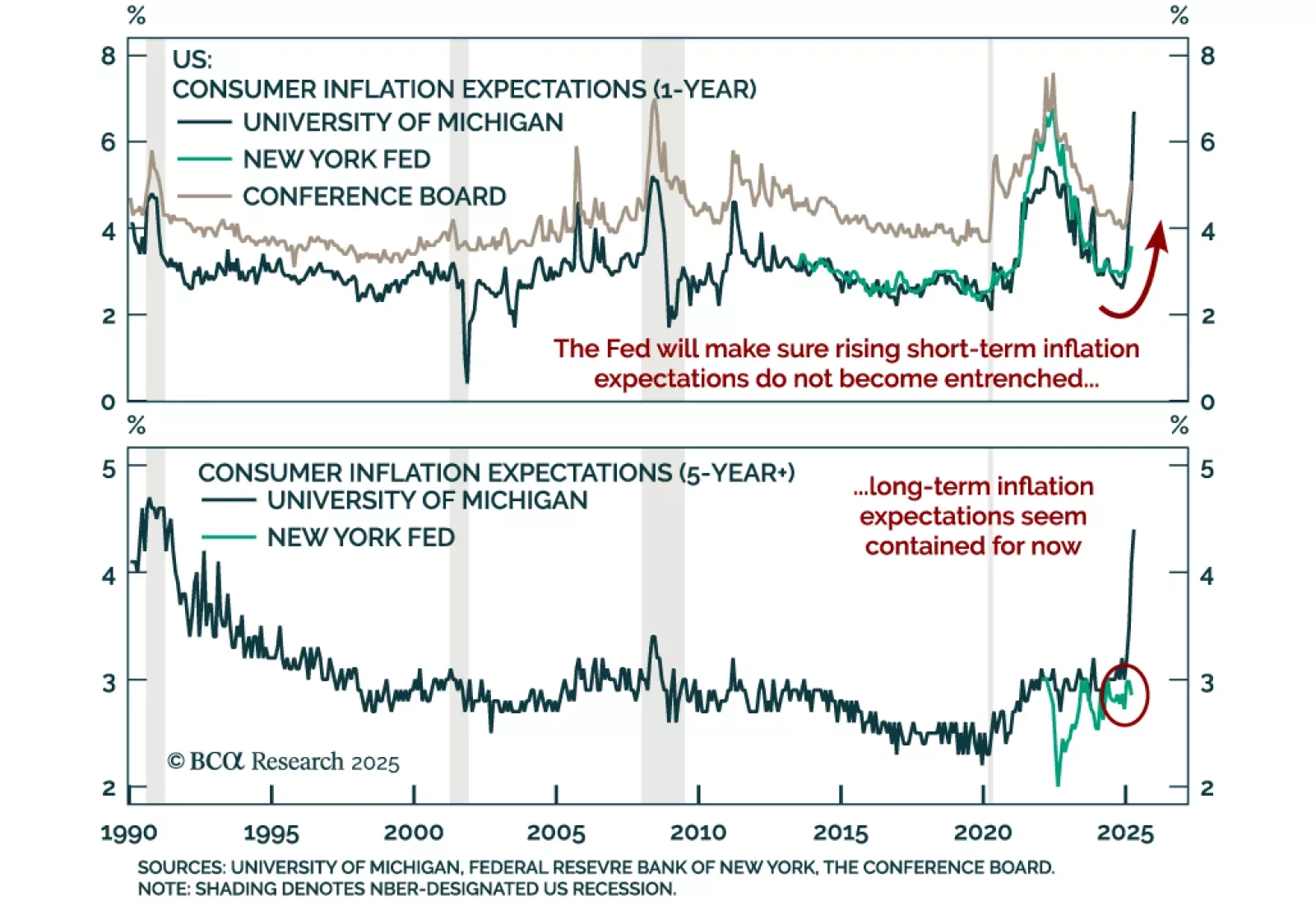

The latest NY Fed Survey of Consumer Expectations reinforces our defensive stance, with growth concerns deepening even as long-term inflation expectations remain anchored. The survey is a useful cross-check against broader sentiment…

The recent breakdown in cross-asset correlations highlights mounting risk premia on US assets. Last week, the long-standing correlations underpinning our understanding of global markets violently broke down. The Treasury market…