Highlights Investment Grade Sector Valuation: Our investment grade corporate bond sector valuation models for the US, euro area, UK, Canada and Australia show some common messages, as markets have adjusted to a virus-stricken world.…

Underweight Heavily indebted utilities are a high-conviction underweight call for next year. Relative share prices and the 10-year Treasury yield are closely inversely correlated. Now that the risk free asset is having a…

Highlights Portfolio Strategy Interest rates are one of the most important macro drivers of overall equity returns via valuations. BCA’s view of a selloff in the bond market is a key factor underpinning most of our 2020 high-…

Underweight Utilities stocks have been all the rave this year, but given their small weighting in the SPX they only explain a very small part of the broad market’s run (in contrast, the heavyweight tech sector…

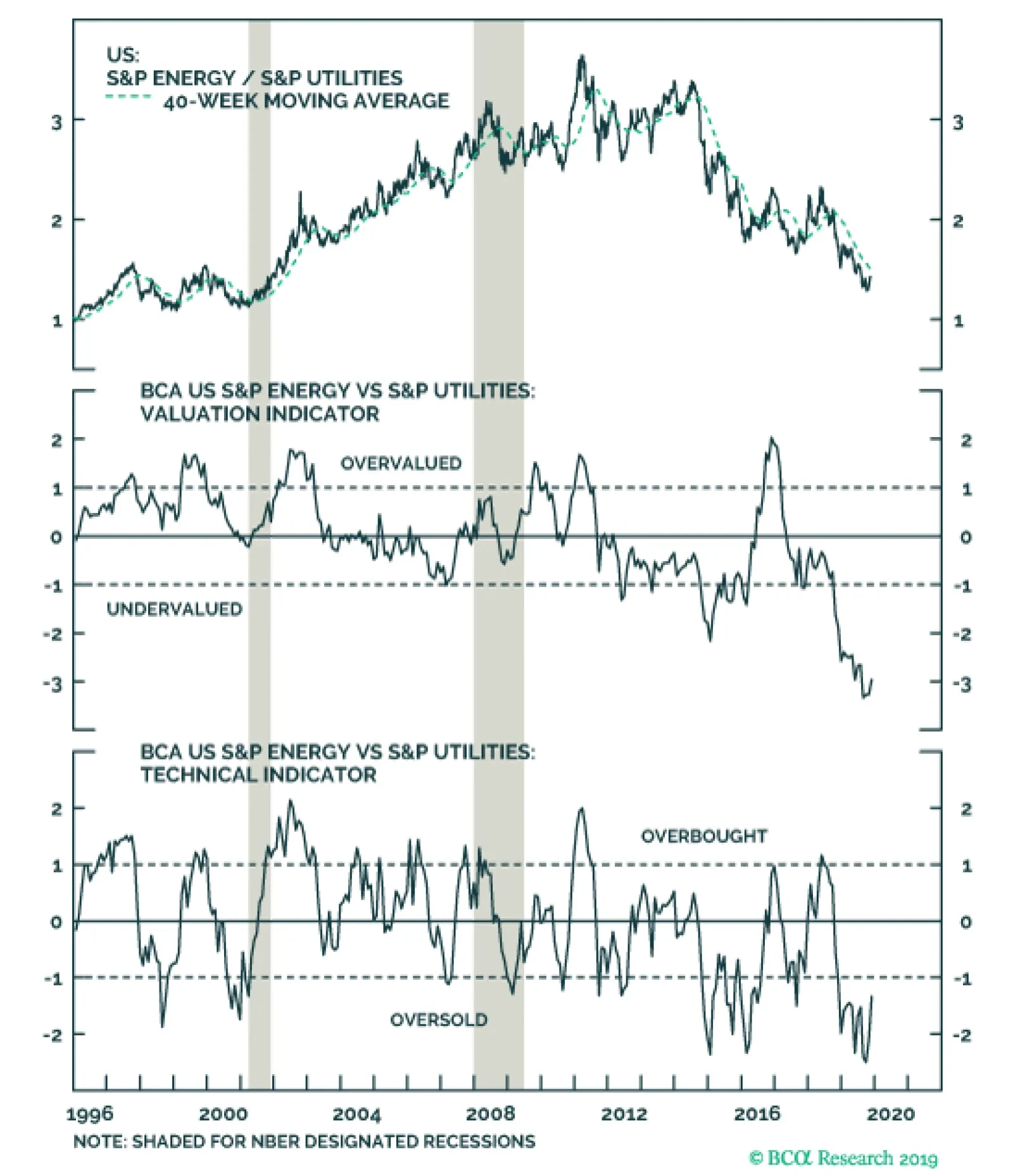

In this Monday’s Weekly Report, we initiated a market-neutral long S&P energy/short S&P utilities pair trade. The middle panel shows that energy stocks have come full circle and are trading at levels last seen…

Energy stocks have come full circle and are trading at levels last seen two decades ago when WTI oil was fetching less than half of today’s $55/bbl price. Encouragingly, there seems to be long-term support for relative…

Highlights Portfolio Strategy Depressed technicals, compelling valuations, macro tailwinds, improving operating fundamentals and the messages from our relative profit growth models and relative Cyclical Macro Indicators all signal…