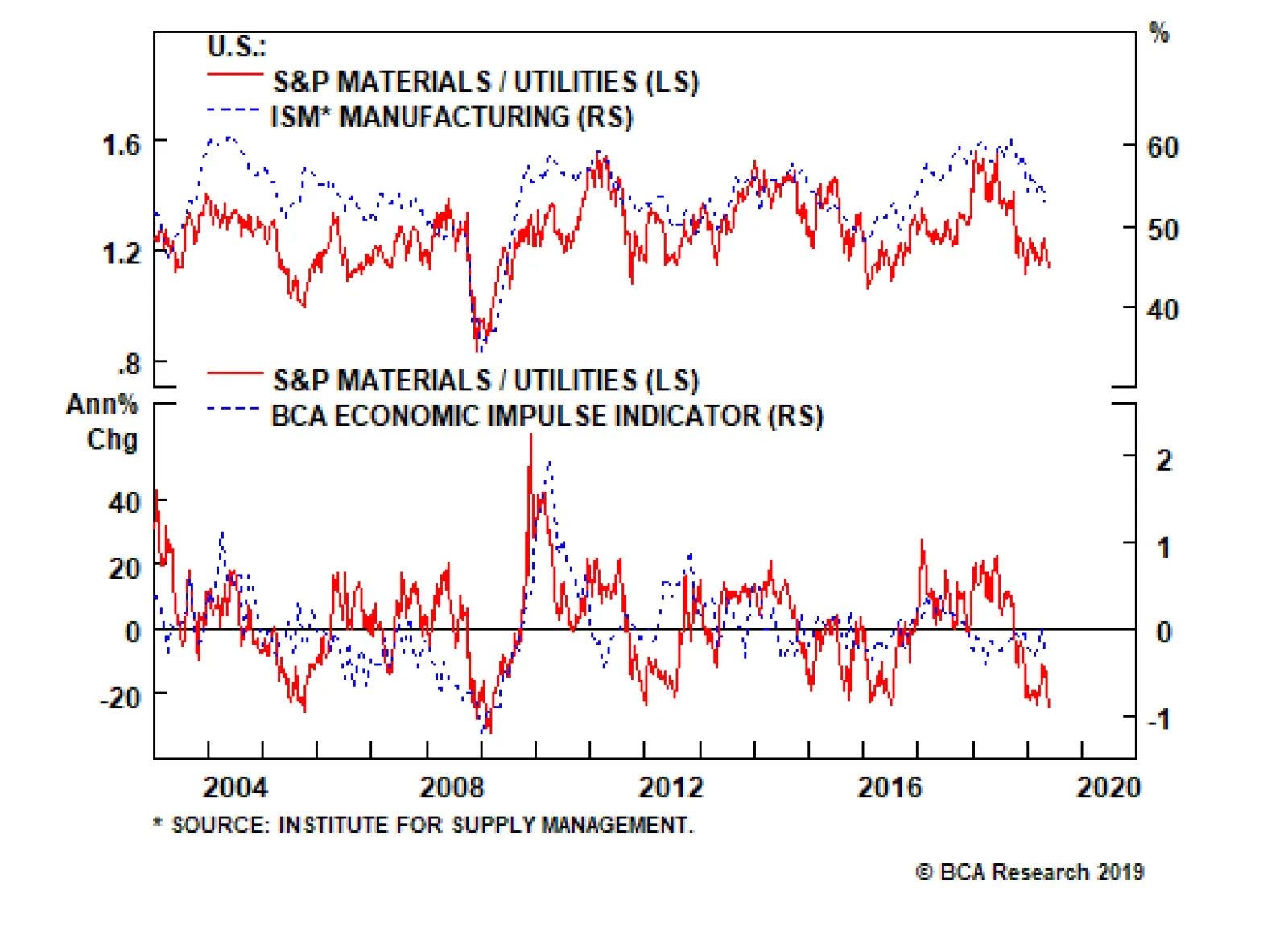

BCA’s global synchronicity indicator, which gauges the number of countries with a PMI above versus below 50 is sinking like a stone. In fact, the overall global manufacturing PMI is just barely above the expansion/…

More specifically on the domestic front, our Economic Impulse Indicator (EII) suggests that beneath the surface some cracks are appearing in the U.S. economy. The EII encapsulates six parts of the U.S. economy and on a second…

Highlights Portfolio Strategy Macro headwinds, deficient demand along with rising chemicals stockpiles that have dealt a blow to industry pricing power warn that chemicals stocks are on the verge of a breakdown. Downgrade to a below…

Key Portfolio Highlights The S&P 500 has started 2019 with a bang as dovish cooing from the Fed has proven a tonic for equities. While we have not entirely retraced the path to the early-autumn highs, our strategy of staying…

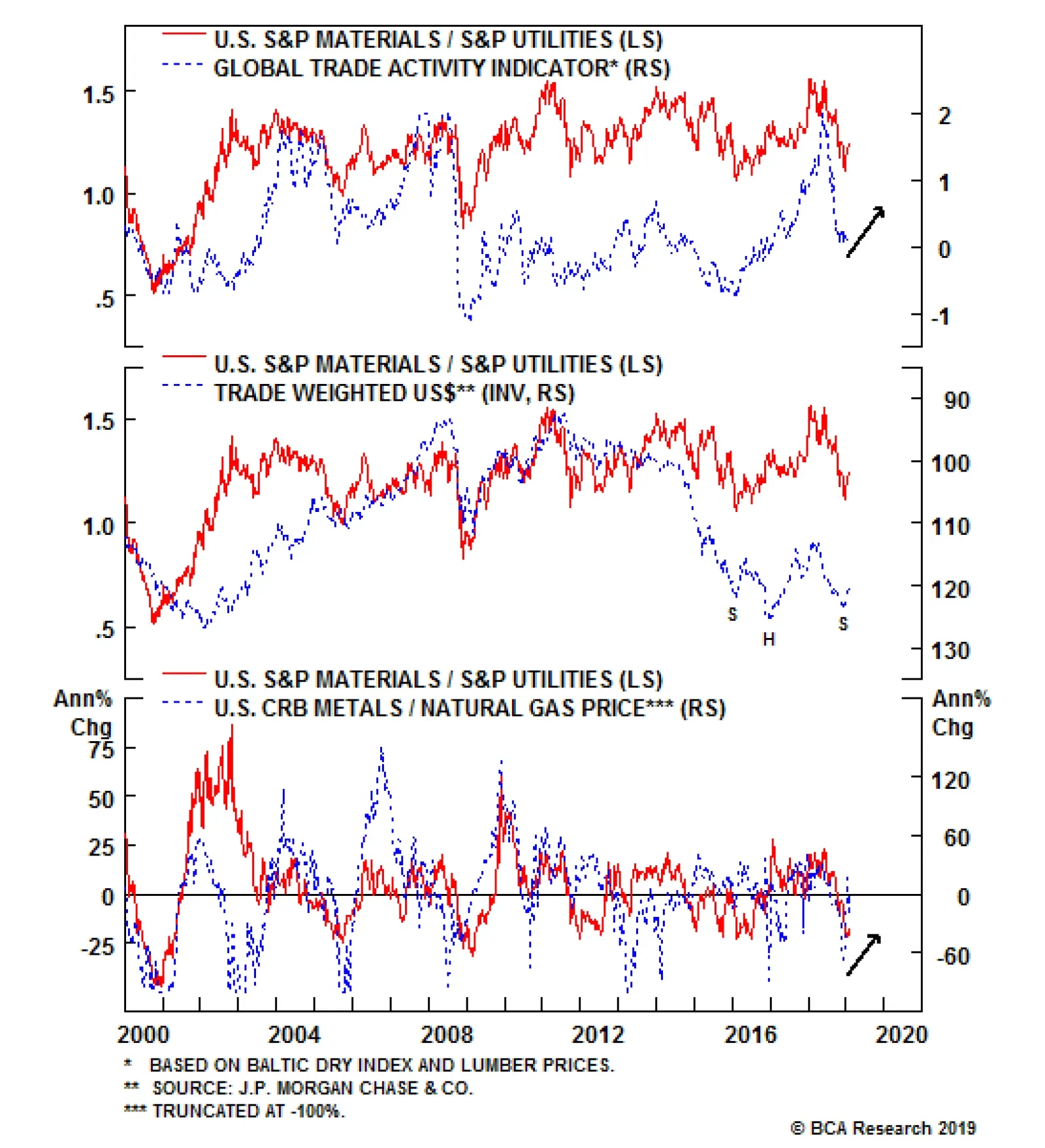

The global growth slowdown is last year’s story. The surprise this year would be if global growth picks up on the back of a positive resolution to the U.S./China trade dispute. Our Global Trade Activity Indicator (GTAI) is…

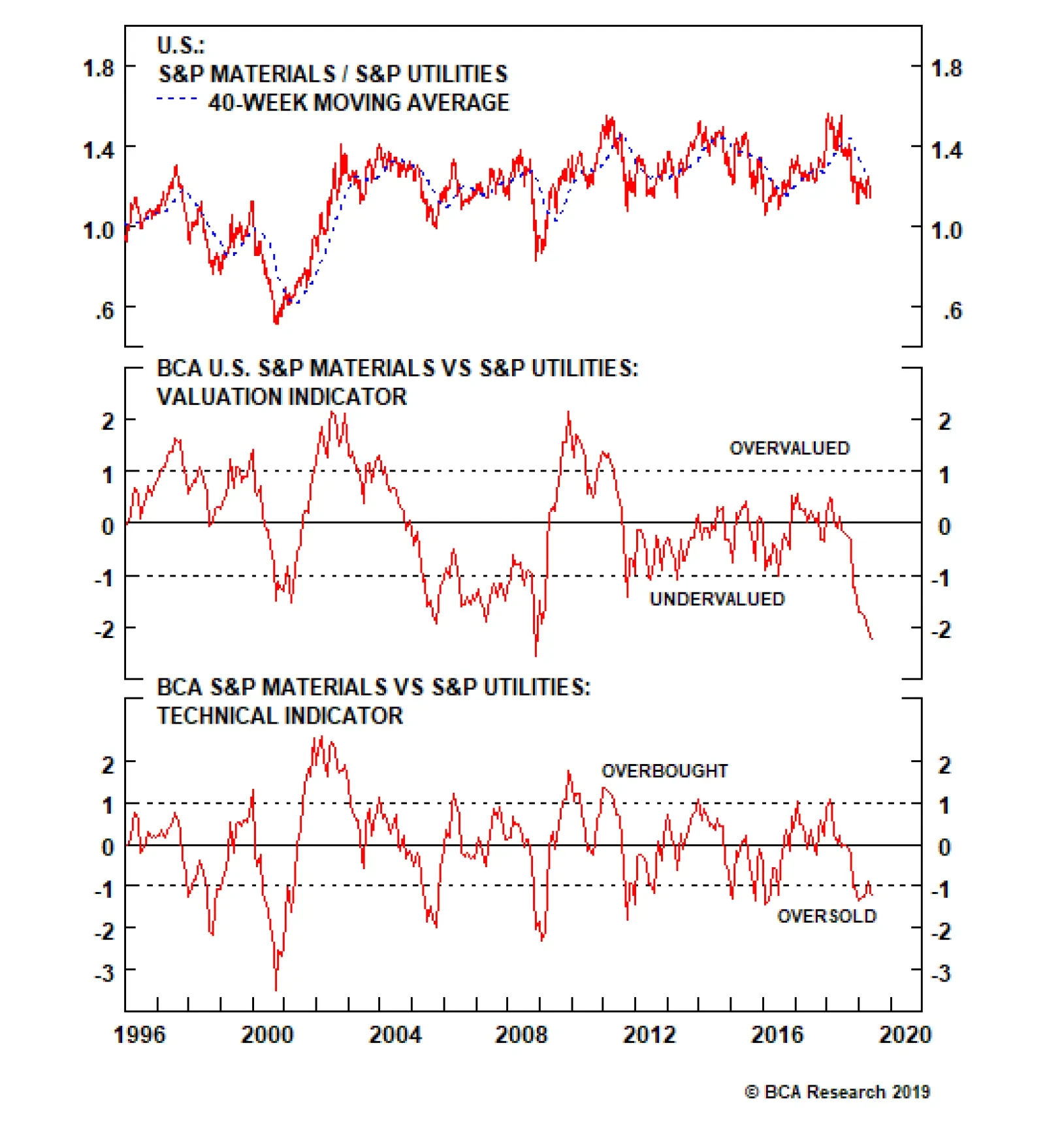

A playable market-neutral opportunity has resurfaced to buy materials at the expense of utilities stocks and in yesterday’s Weekly Report, we outline our top seven reasons why investors should put on this pair trade on a…

Highlights Portfolio Strategy We highlight our top seven reasons of why it pays to initiate a long materials/short utilities pair trade this week. Enticing long-term residential real estate prospects, a vibrant labor market, the recent…

Underweight The S&P utilities index has been on a roll recently as this fixed income proxy has reacted to the recent fall in Treasury yields (change in yields shown inverted, top panel) and jump in natural gas…