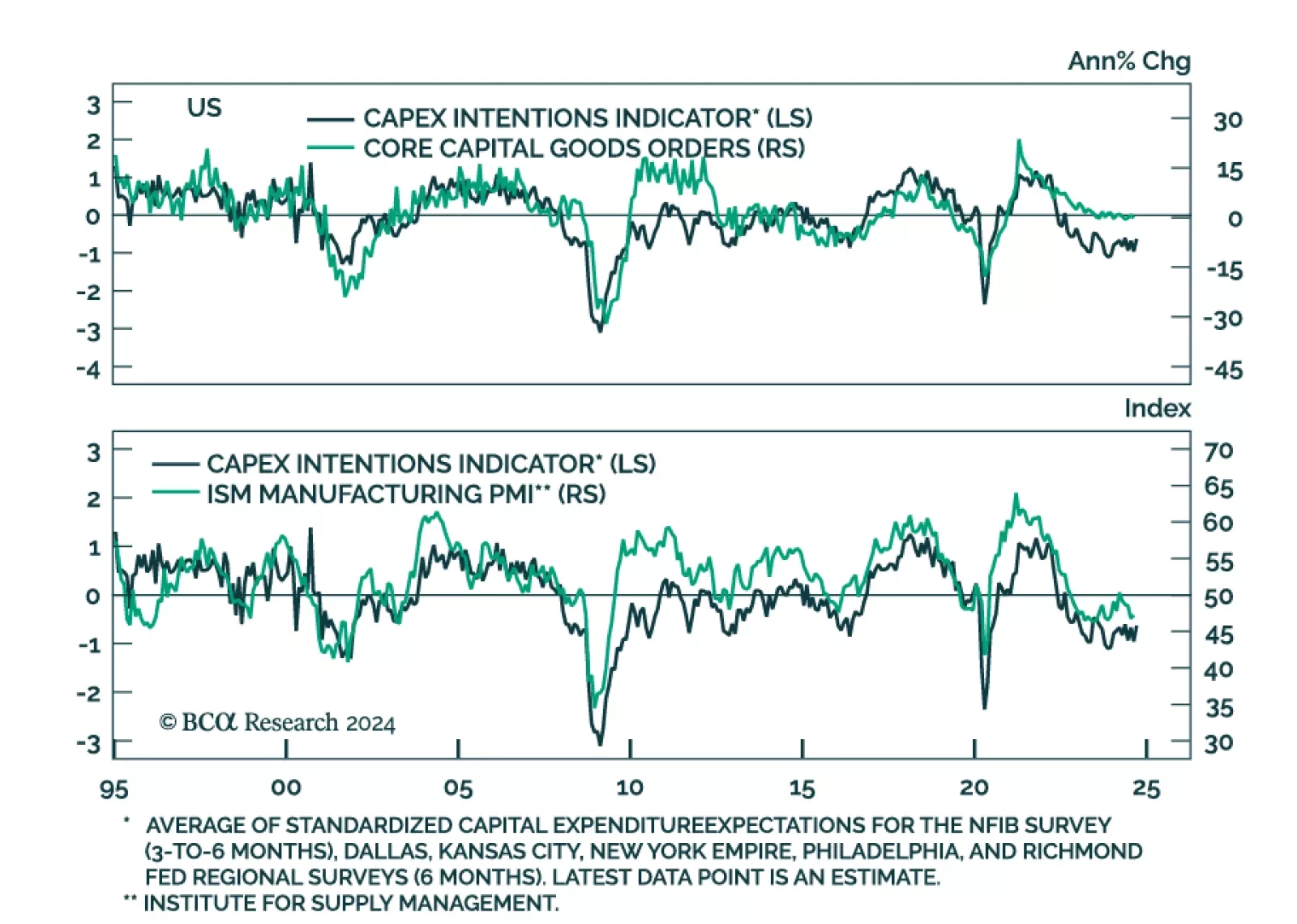

Preliminary estimates suggested that US durable goods orders stagnated in August after having surged 9.9% m/m in July, and beating expectations they would decline. Excluding the volatile transportation component, however, durable…

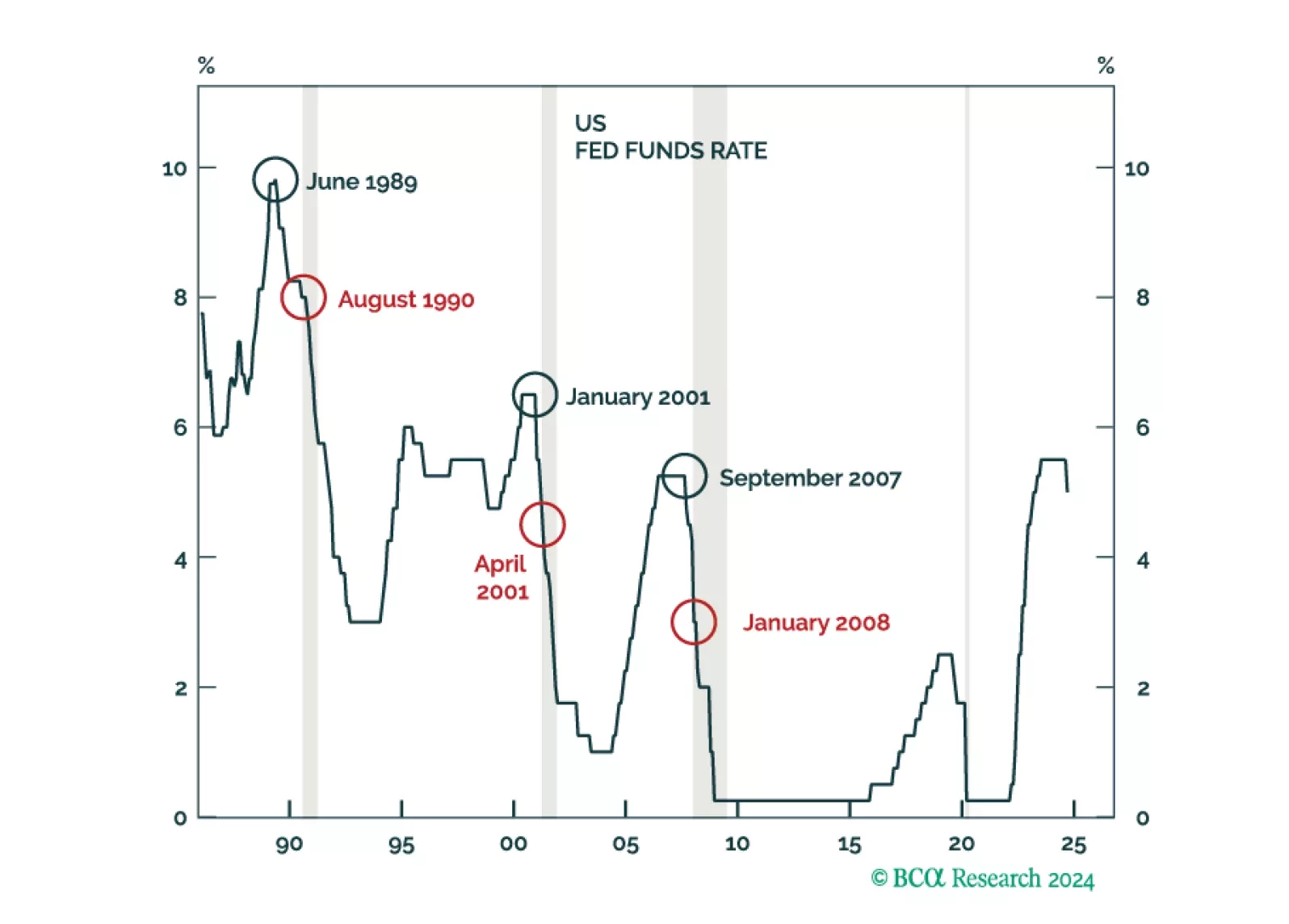

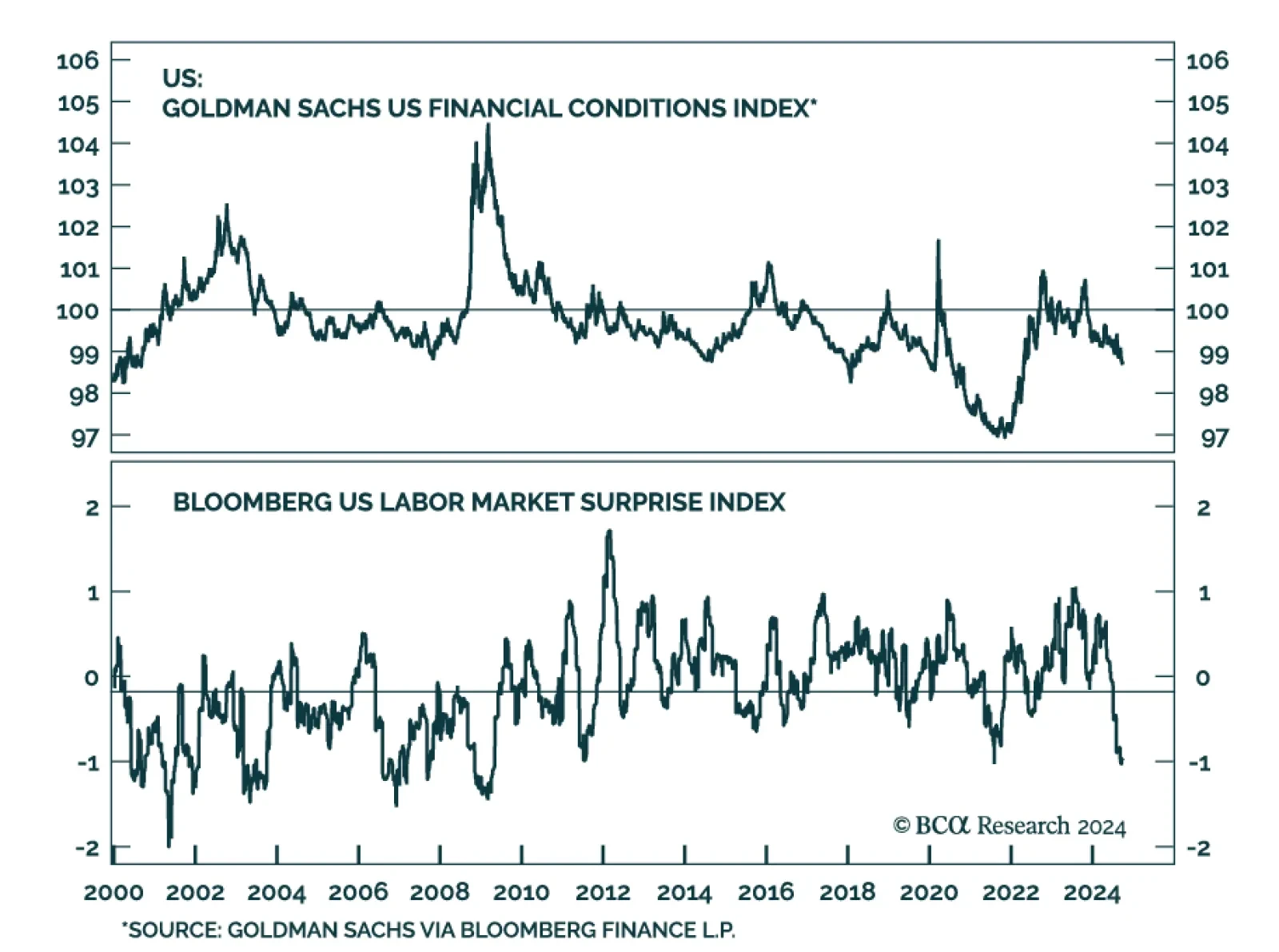

Our expectation that a looming US recession will morph into a global recession remains intact. US monetary easing will only take effect with a lag and current deteriorating economic conditions are the product of past…

US financial conditions have become noticeably easier since August. The Fed has embarked on its easing cycle with a bang, sending equities higher and spreads lower, while the trade-weighted dollar gave back more than half of its…

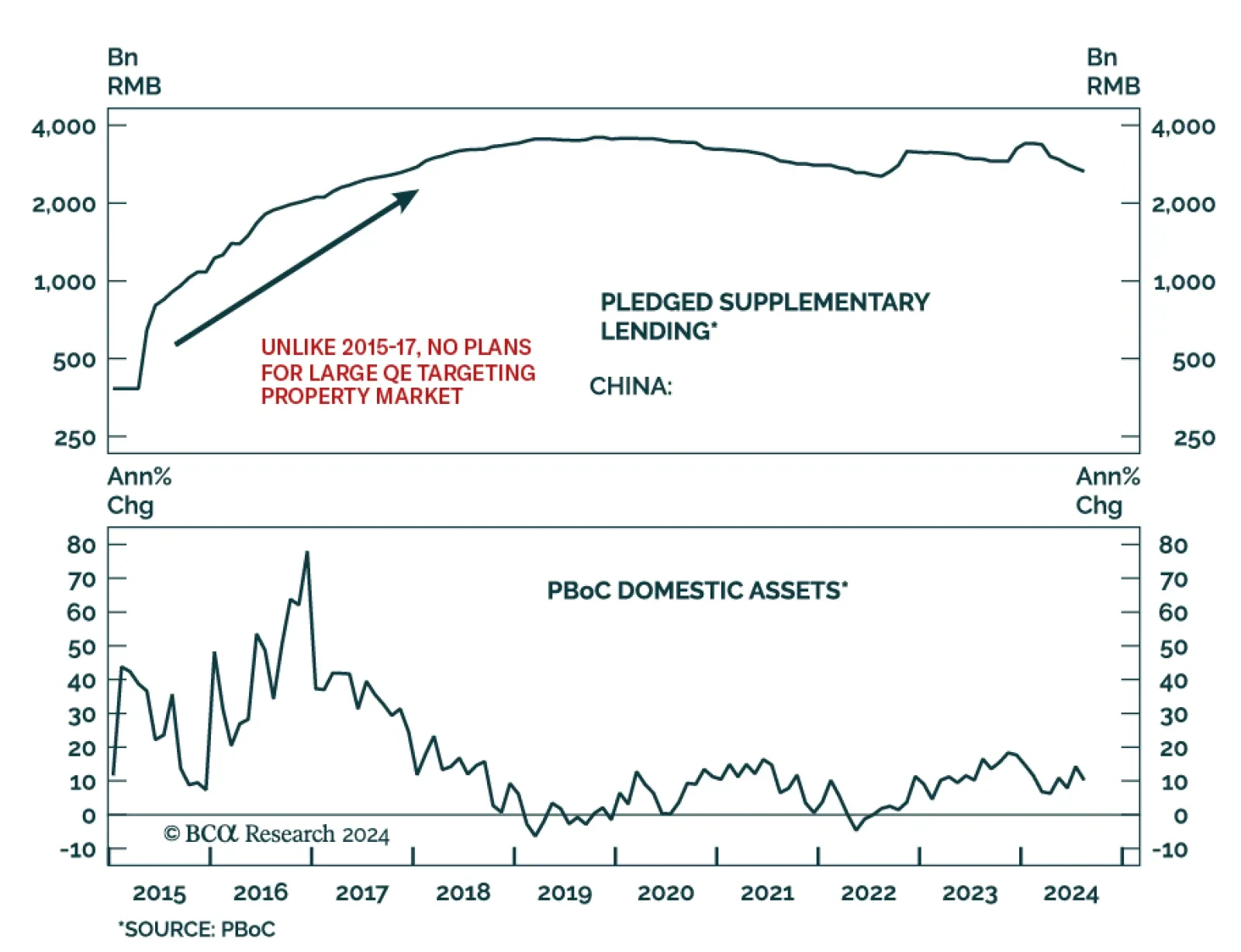

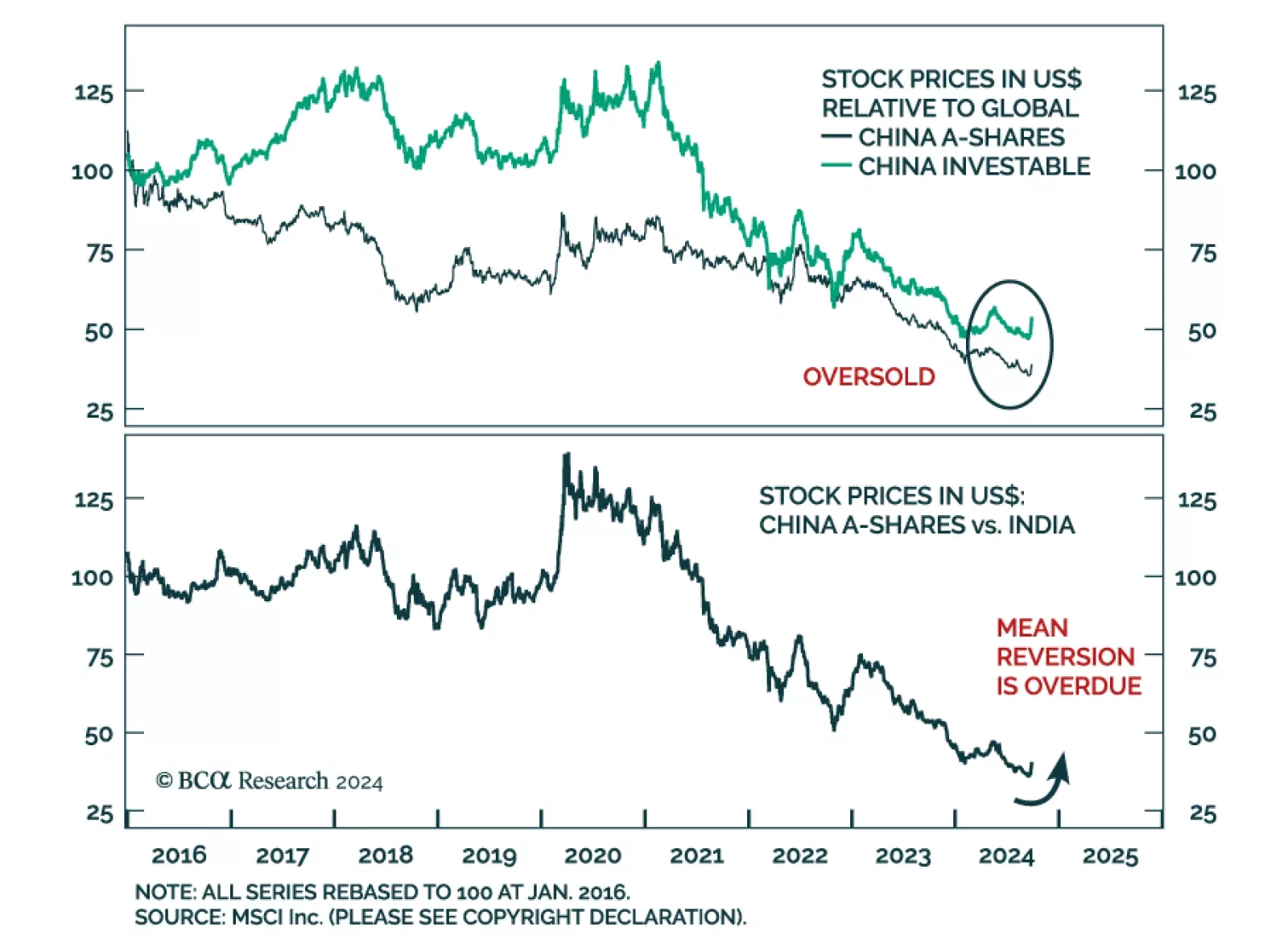

According to BCA Research’s Emerging Market Strategy service, the monetary and fiscal policies announced last week are unlikely to produce a meaningful business cycle recovery in China. Below are actions the authorities…

After resisting the consensus narrative in 2022 that a US recession was imminent, and then predicting an immaculate disinflation for 2023, the Global Investment Strategy team has joined the dark side and is now expecting a recession…

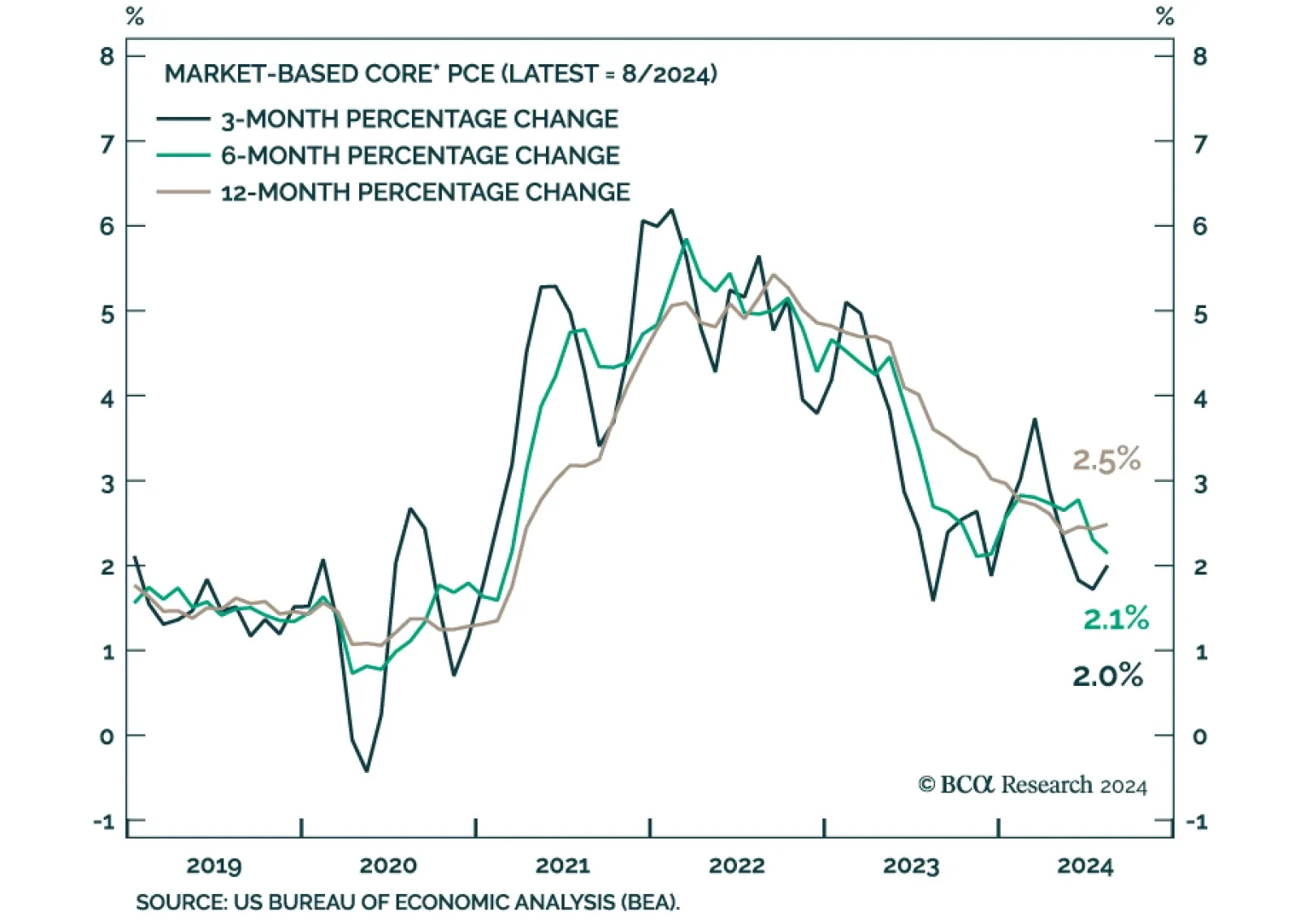

US nominal personal income growth decelerated to a 0.2% pace in August, from 0.3% in July, missing expectations that it would accelerate. Nominal personal spending also disappointed, growing at a slower 0.2% pace from 0.5%. In…

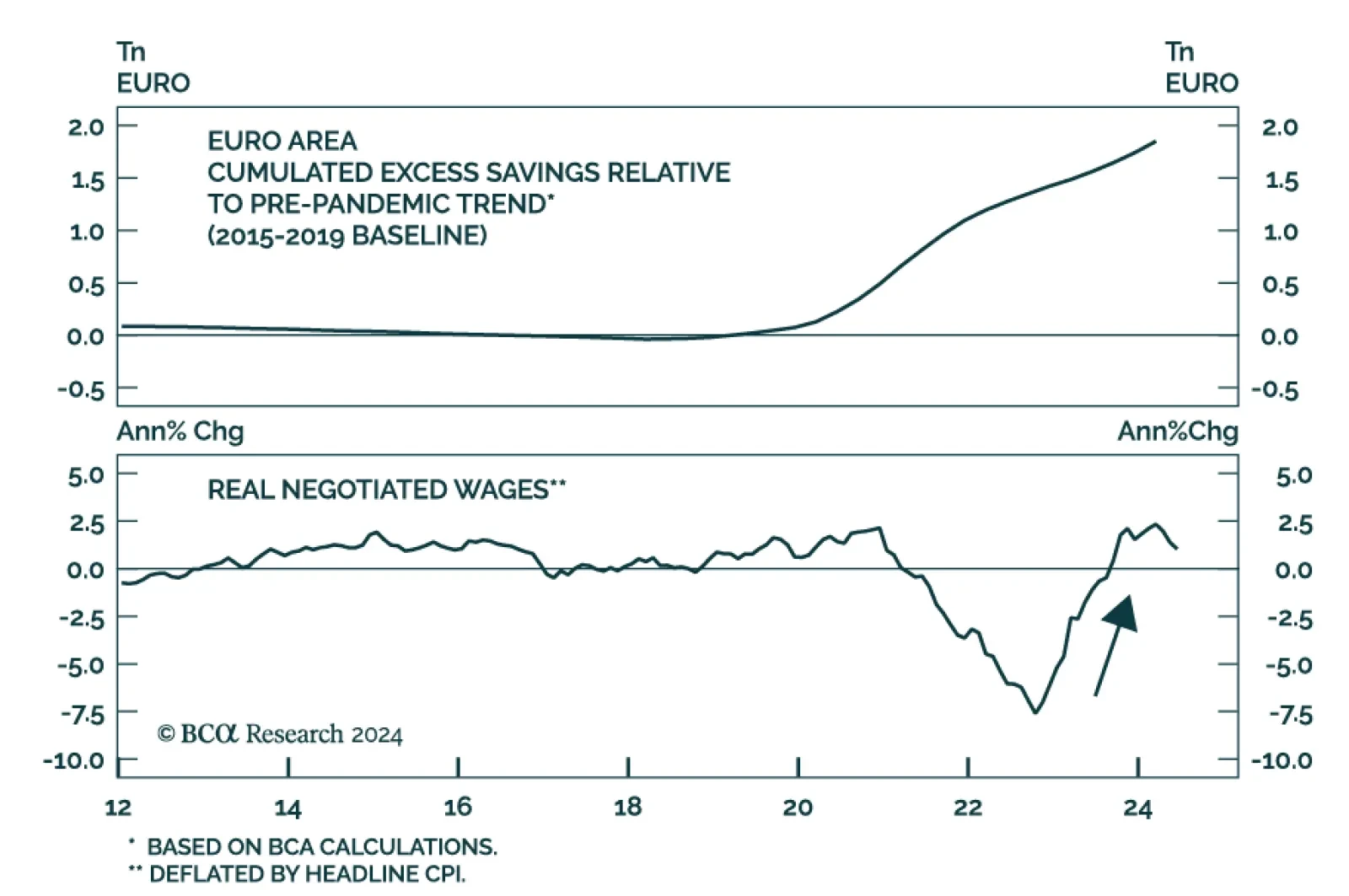

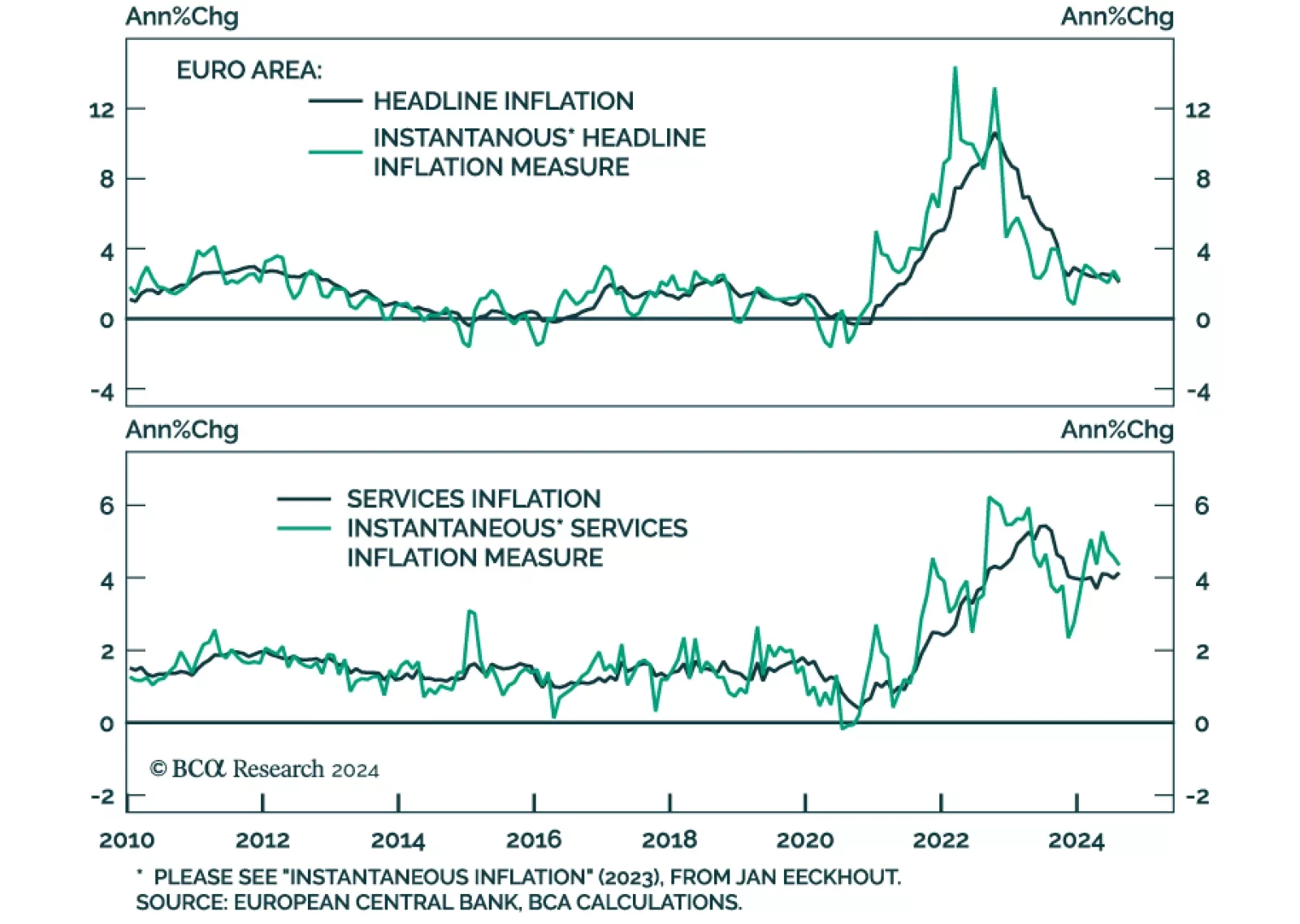

France’s and Spain’s preliminary September CPI readings declined on a month-on-month basis, clocking in at 1.5% and 1.7% y/y respectively, and undershooting consensus expectations. Germany’s and Italy’s…

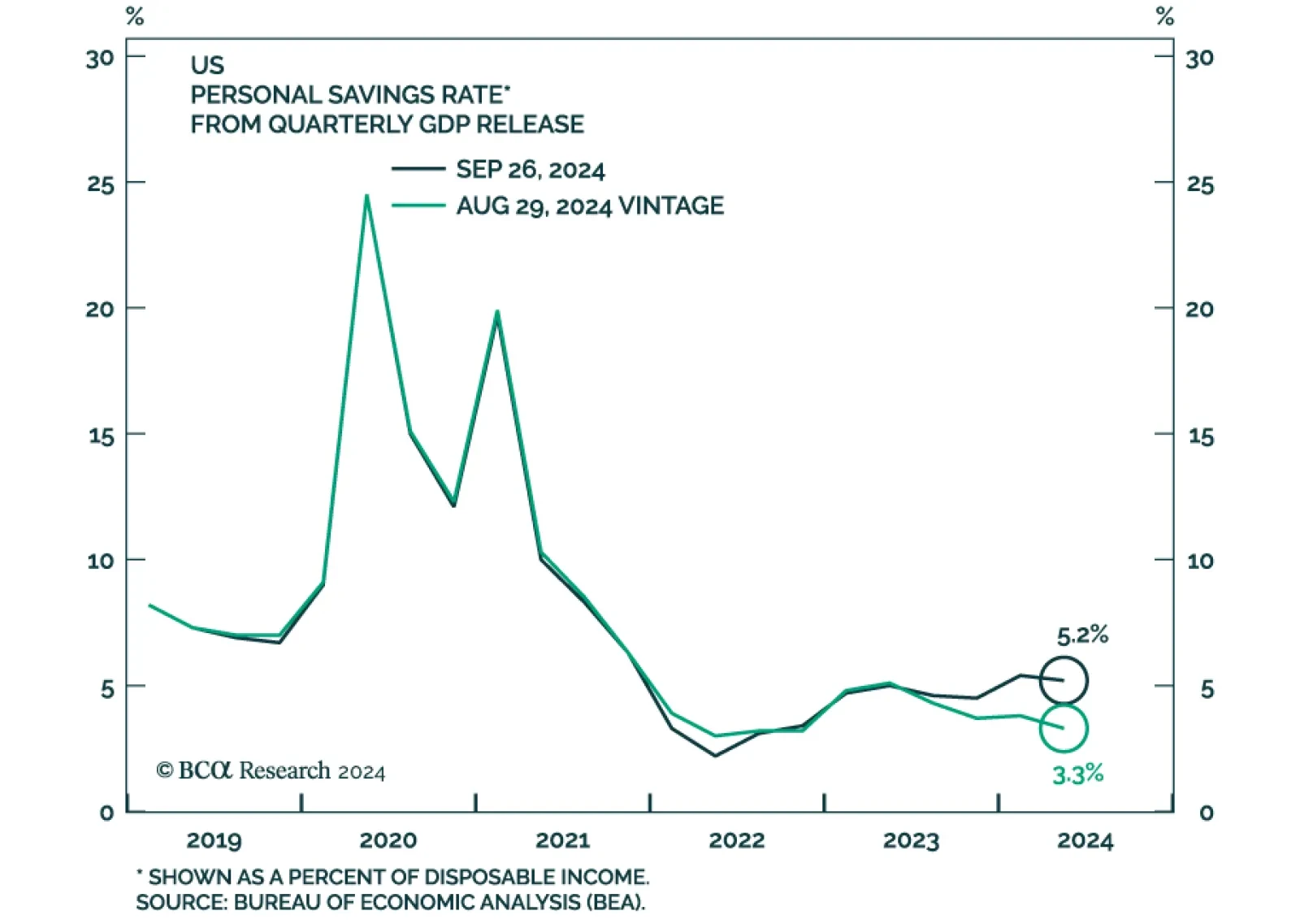

Annual BEA data revisions resulted in a significant upward revision in GDP growth since Q2 2020, led by stronger consumption growth and more robust real disposable income growth than previously believed. Revisions also show…

We highlighted last week that while the Politburo policy announcements are unlikely to produce a meaningful business cycle recovery in China, they nevertheless administered a shot of adrenaline to investor sentiment. Chinese…