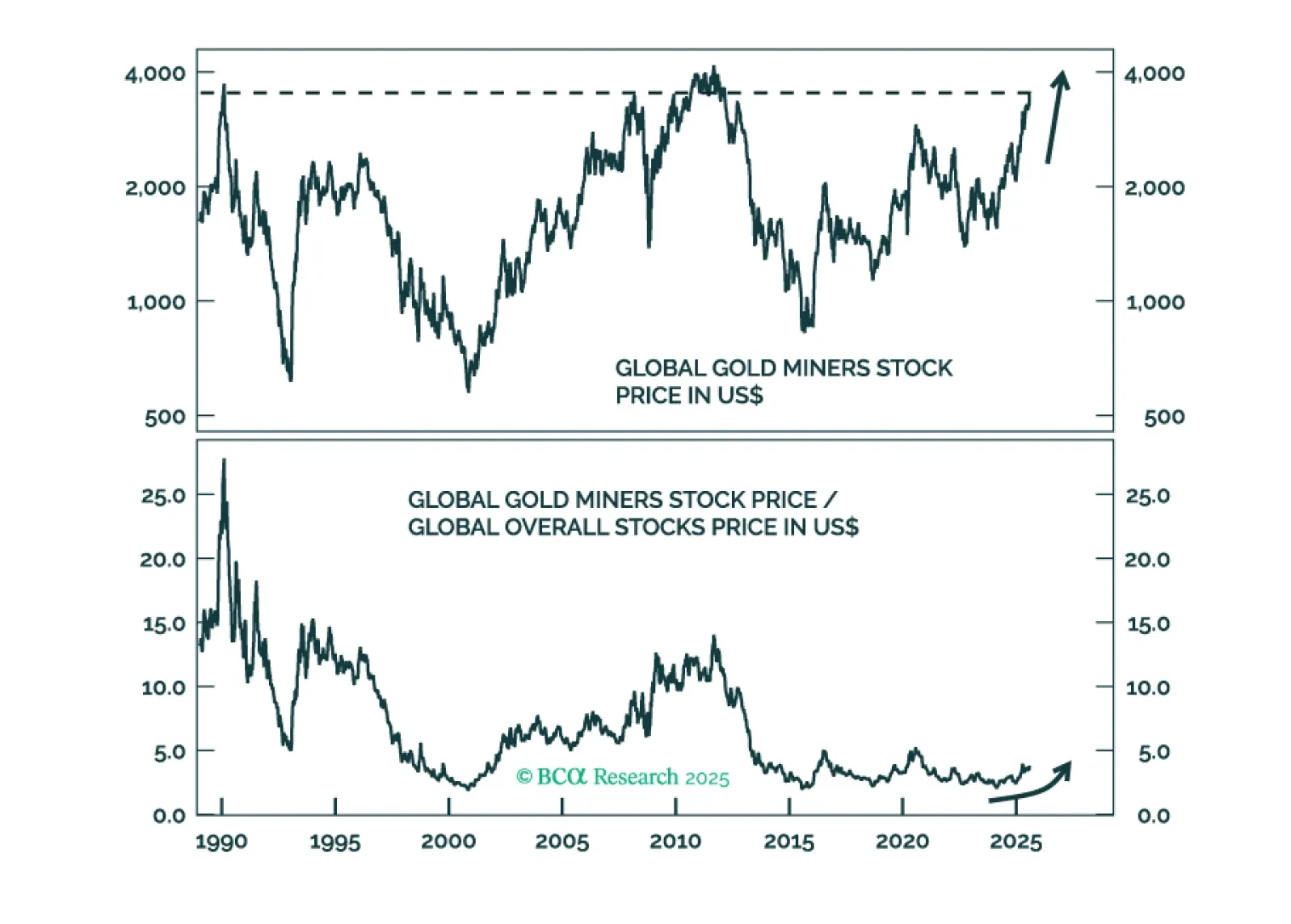

Our Commodity strategists expect gold’s consolidation to resolve in a bullish breakout; buy gold and gold mining stocks in both absolute and relative terms. The metal’s resilience despite unfavorable cyclical drivers points to a…

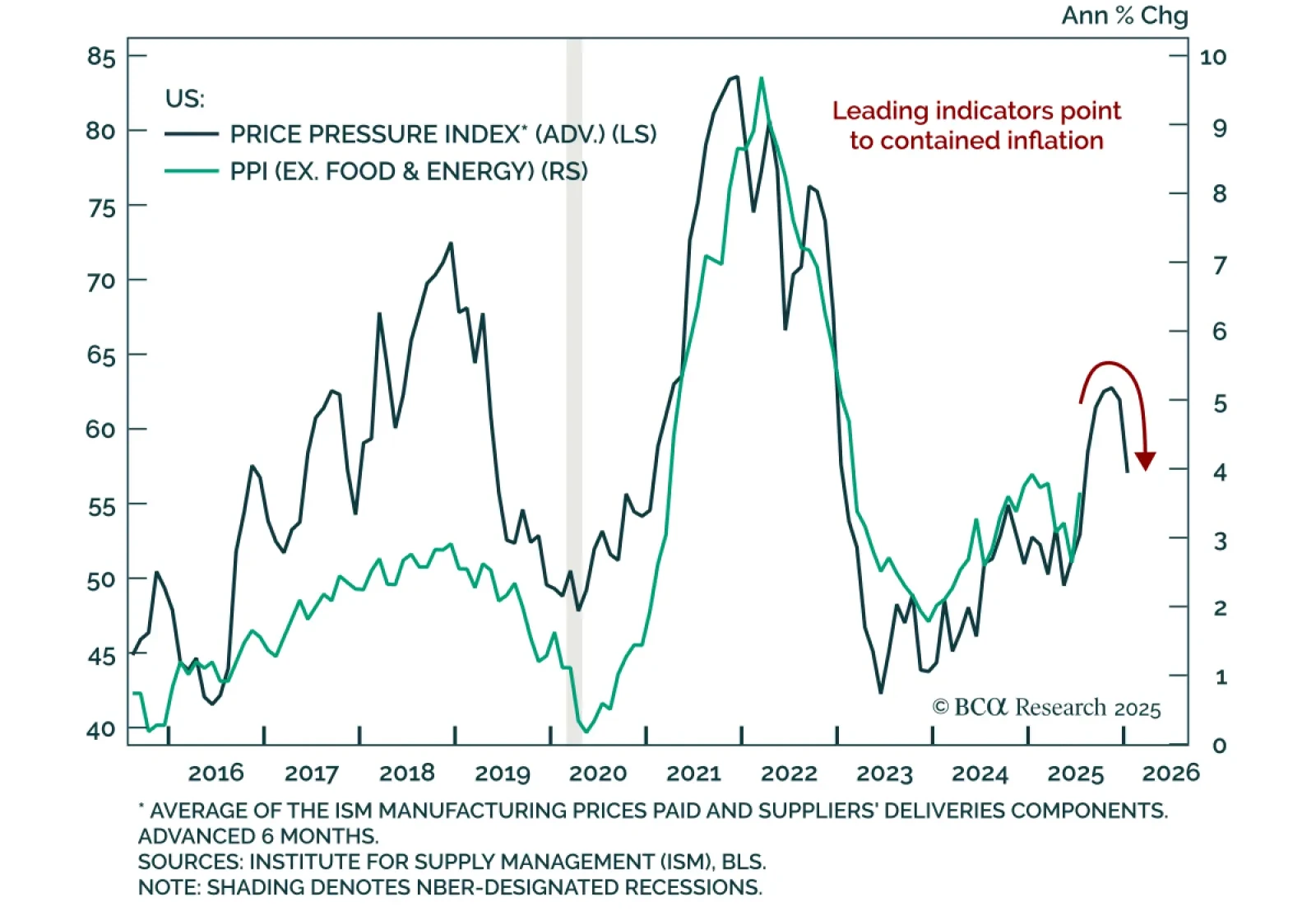

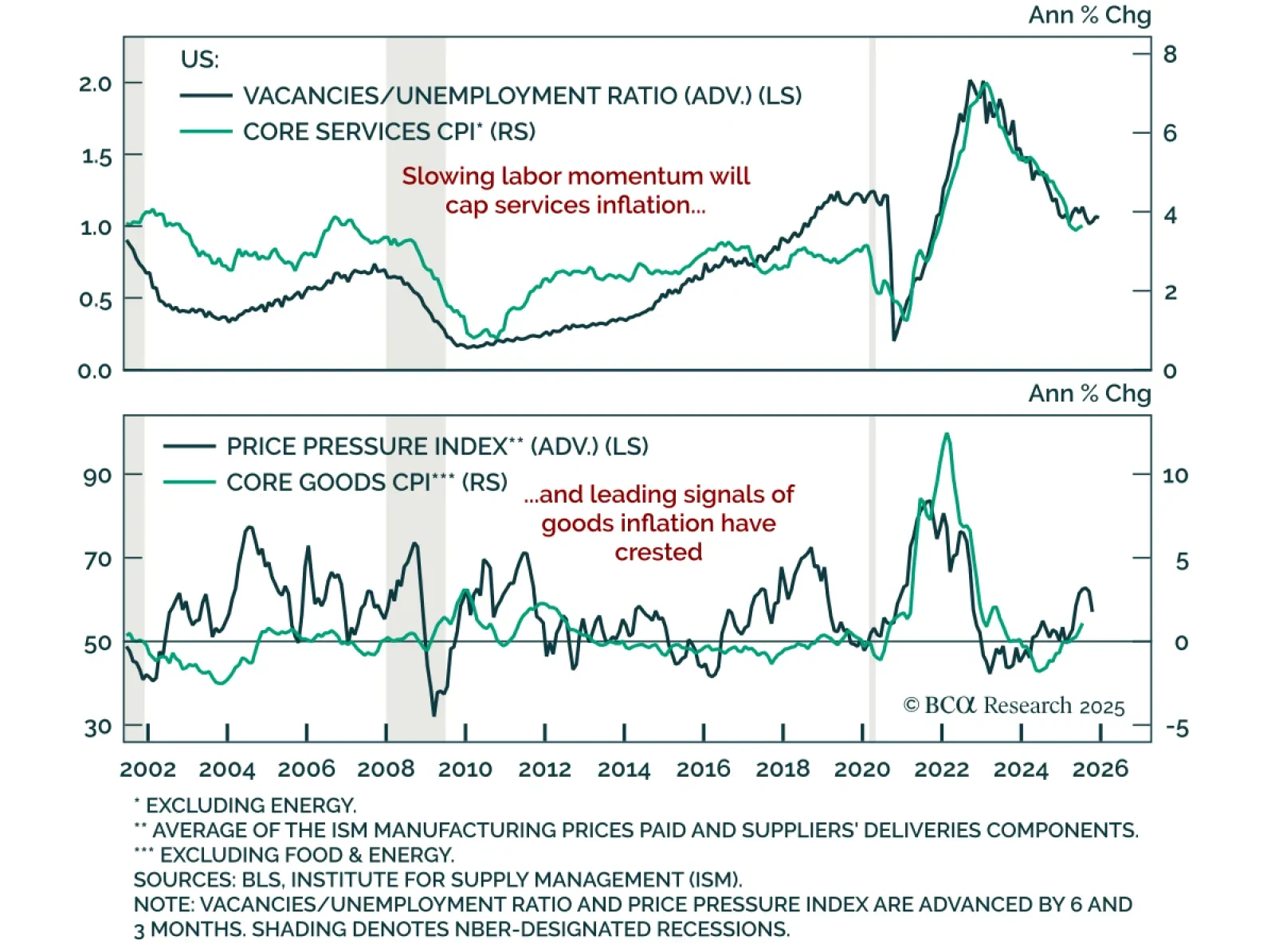

July PPI surprised sharply to the upside, but inflation pressures are likely to remain limited. Headline PPI rose 0.9% m/m (3.3% y/y) in July from 0.0% m/m (2.3% y/y) in June, while core PPI gained 0.6% m/m (2.8% y/y). PPI components…

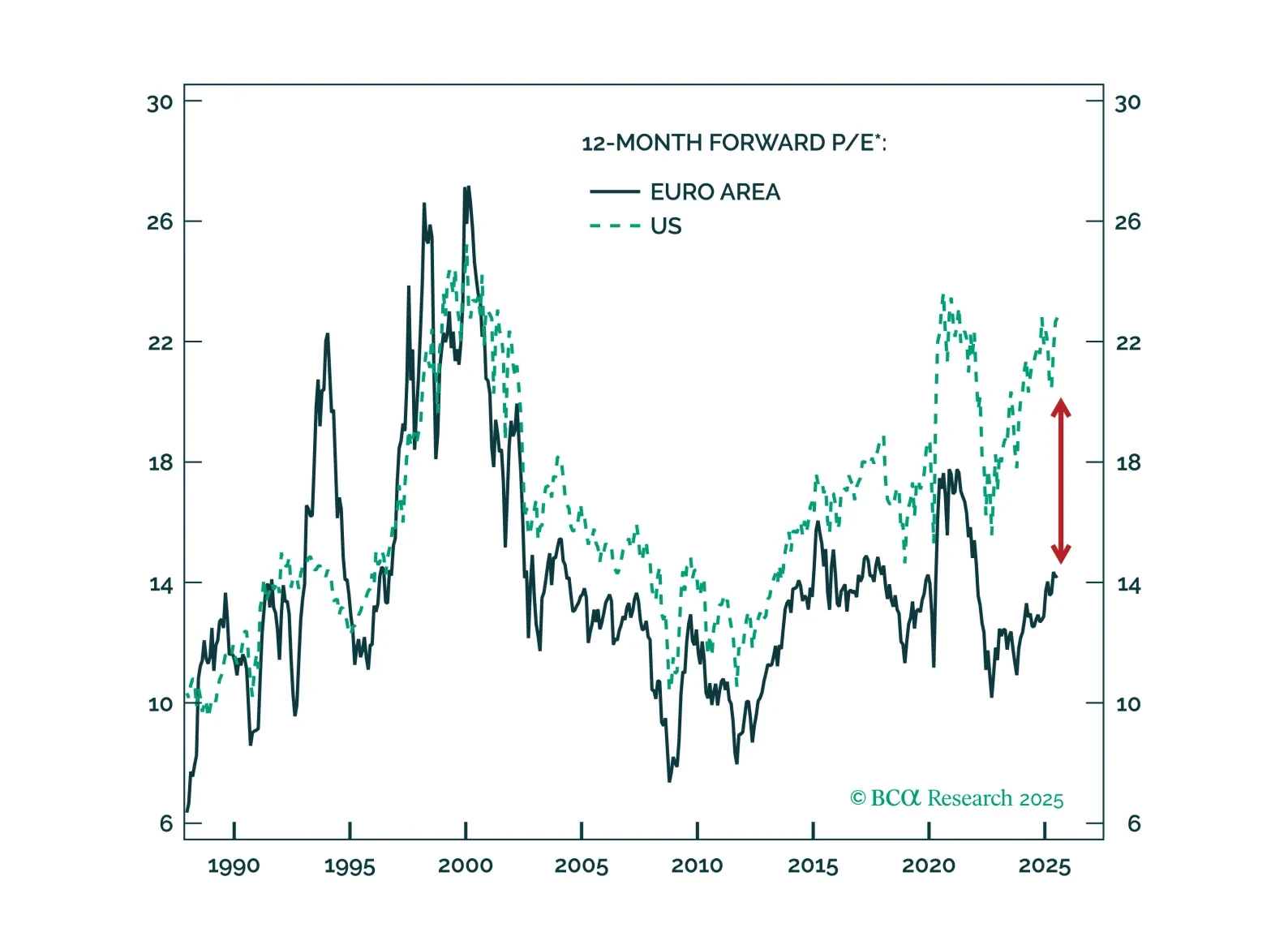

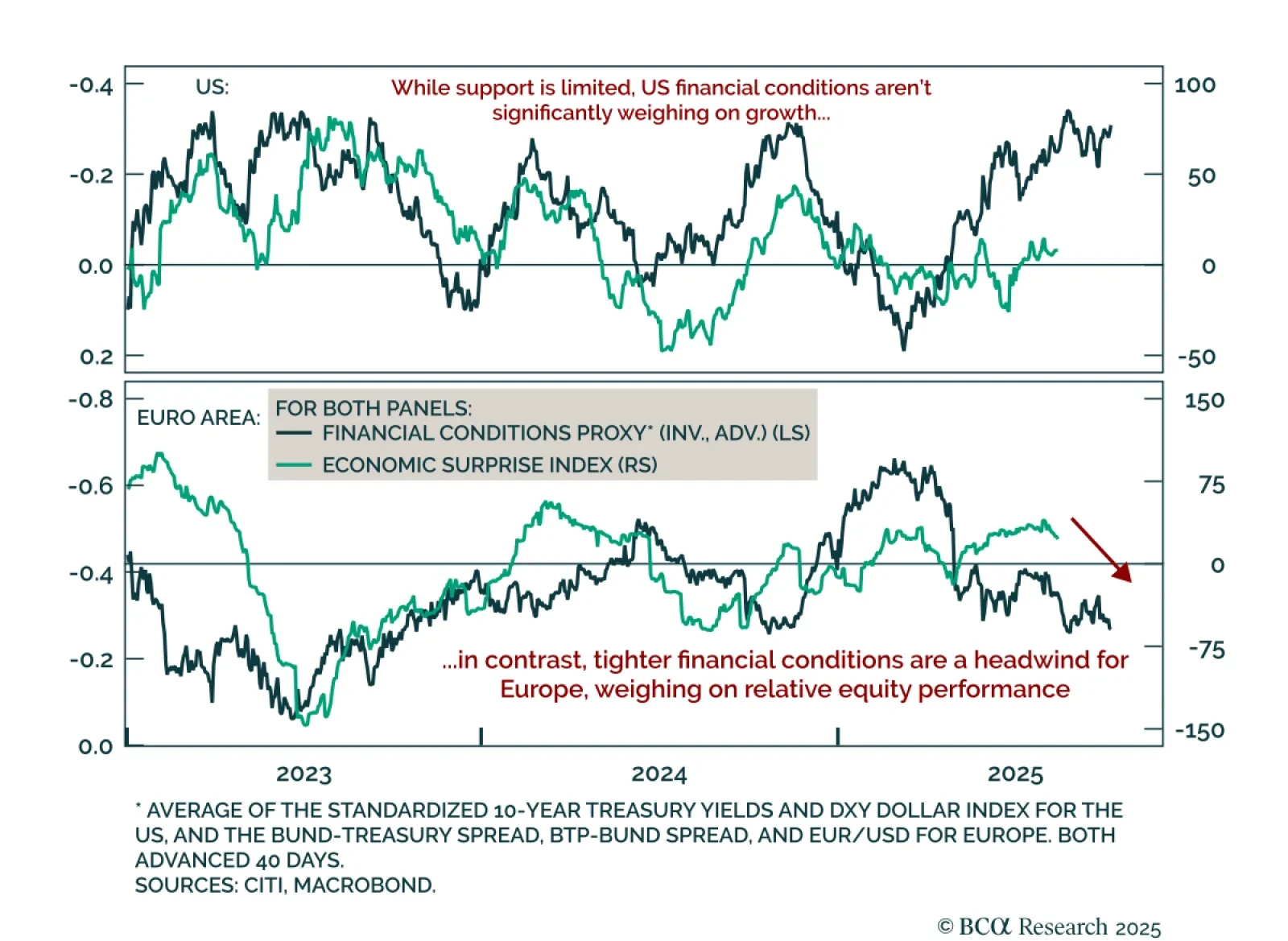

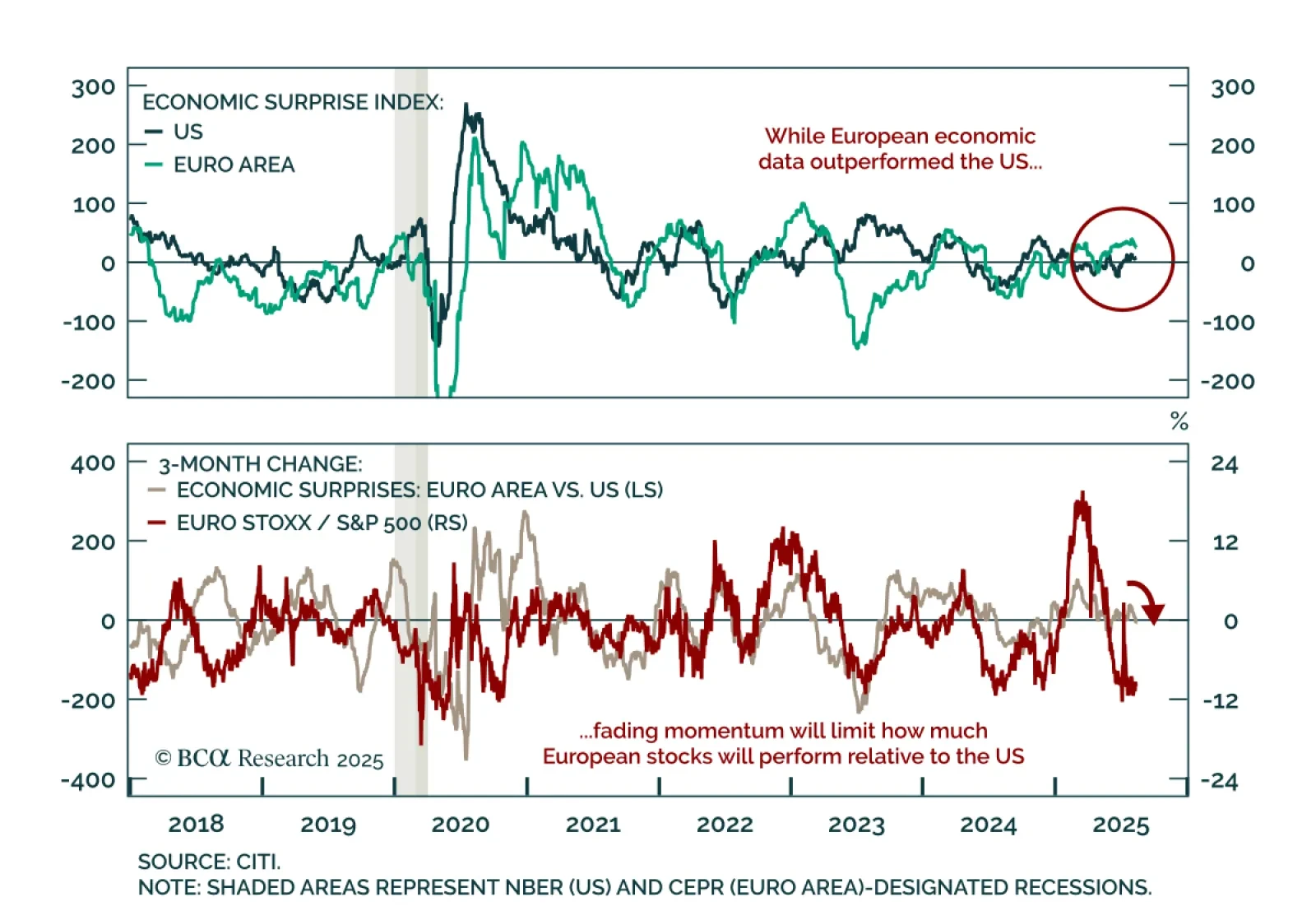

Dollar softness has had little growth impact, and European equities should keep lagging. A key 2025 trend has been USD depreciation, but the associated easing in financial conditions has offered minimal support to US growth,…

US equities are set for tactical outperformance versus Europe, but dips or underperformance in European assets remain entry points for long-term investors. European stocks have stalled below prior highs, while the S&P 500 has…

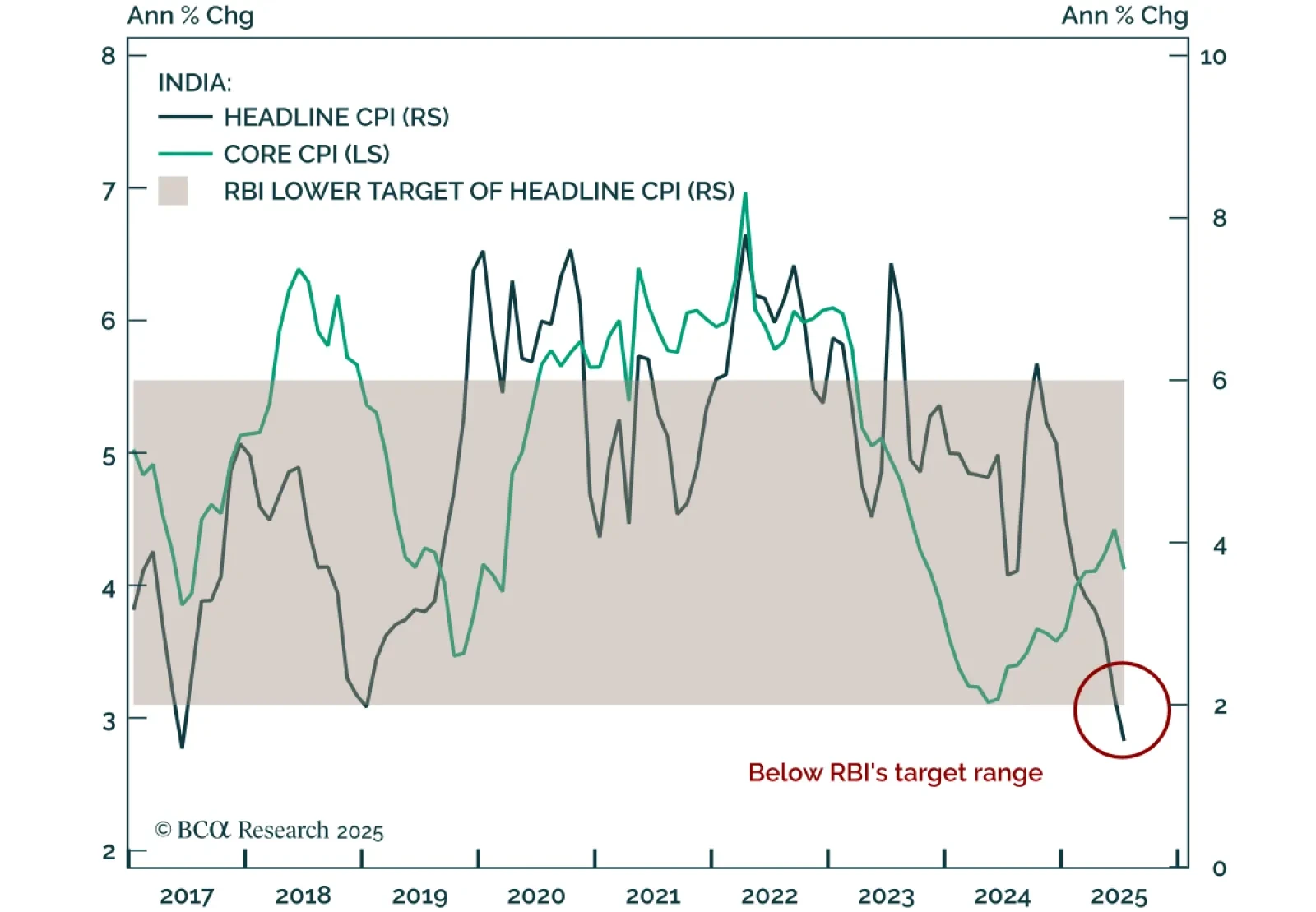

India’s sharp CPI undershoot will bring forward rate cuts, supporting a long on local bonds. Headline CPI fell to 1.55%, well below the RBI’s 2-6% target range, pointing to earlier and deeper easing than markets price. Our…

July US CPI met expectations as leading indicators point to disinflation, supporting our long duration stance and preference for 2s5s steepeners. Headline CPI rose 0.2% m/m (2.7% y/y), while core increased 0.3% m/m and…

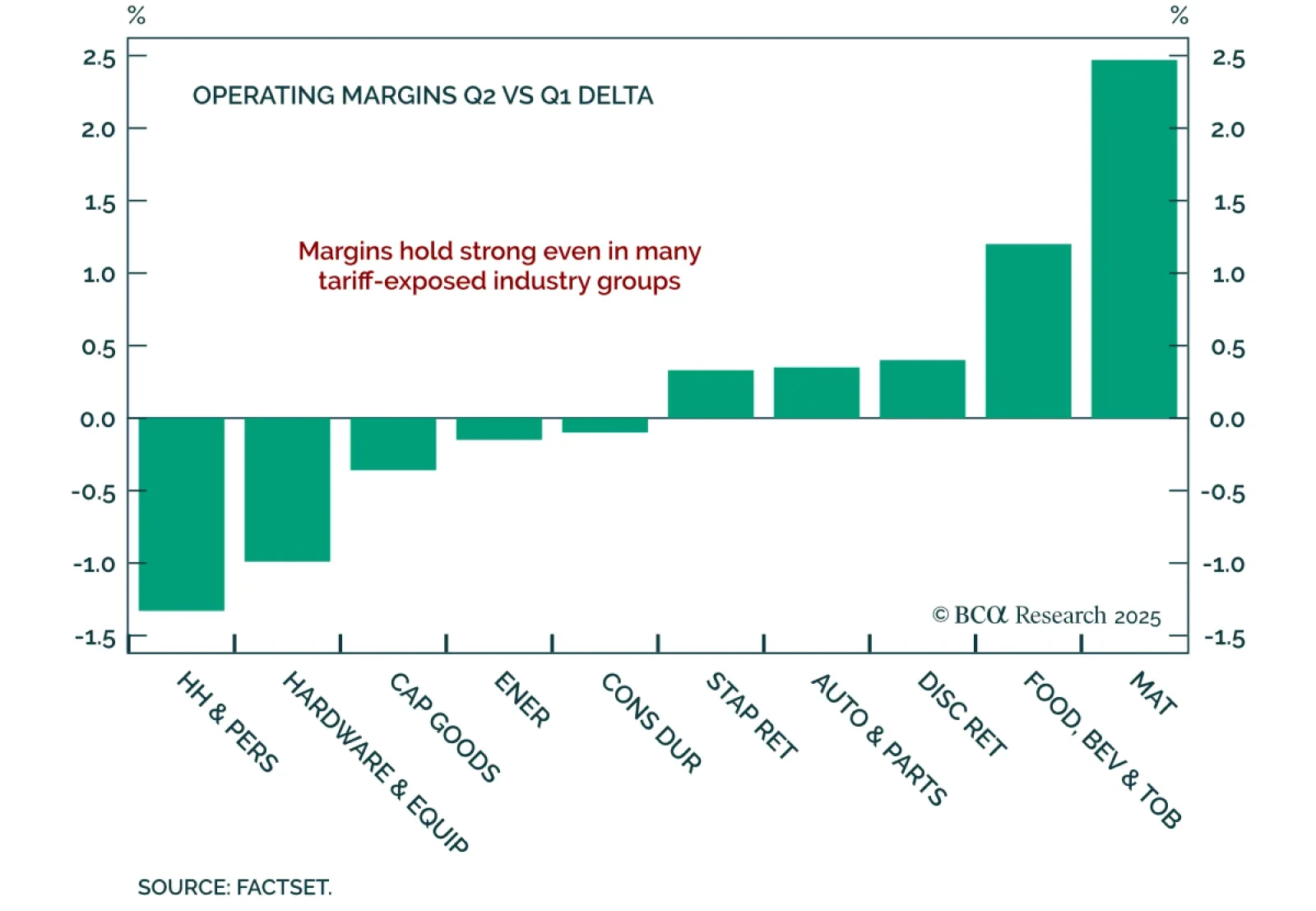

Our US Equity strategists view Q2 earnings as confirmation of corporate resilience, but caution that the full impact of tariffs is still ahead. Strong results show that companies have weathered tariff-related costs through…

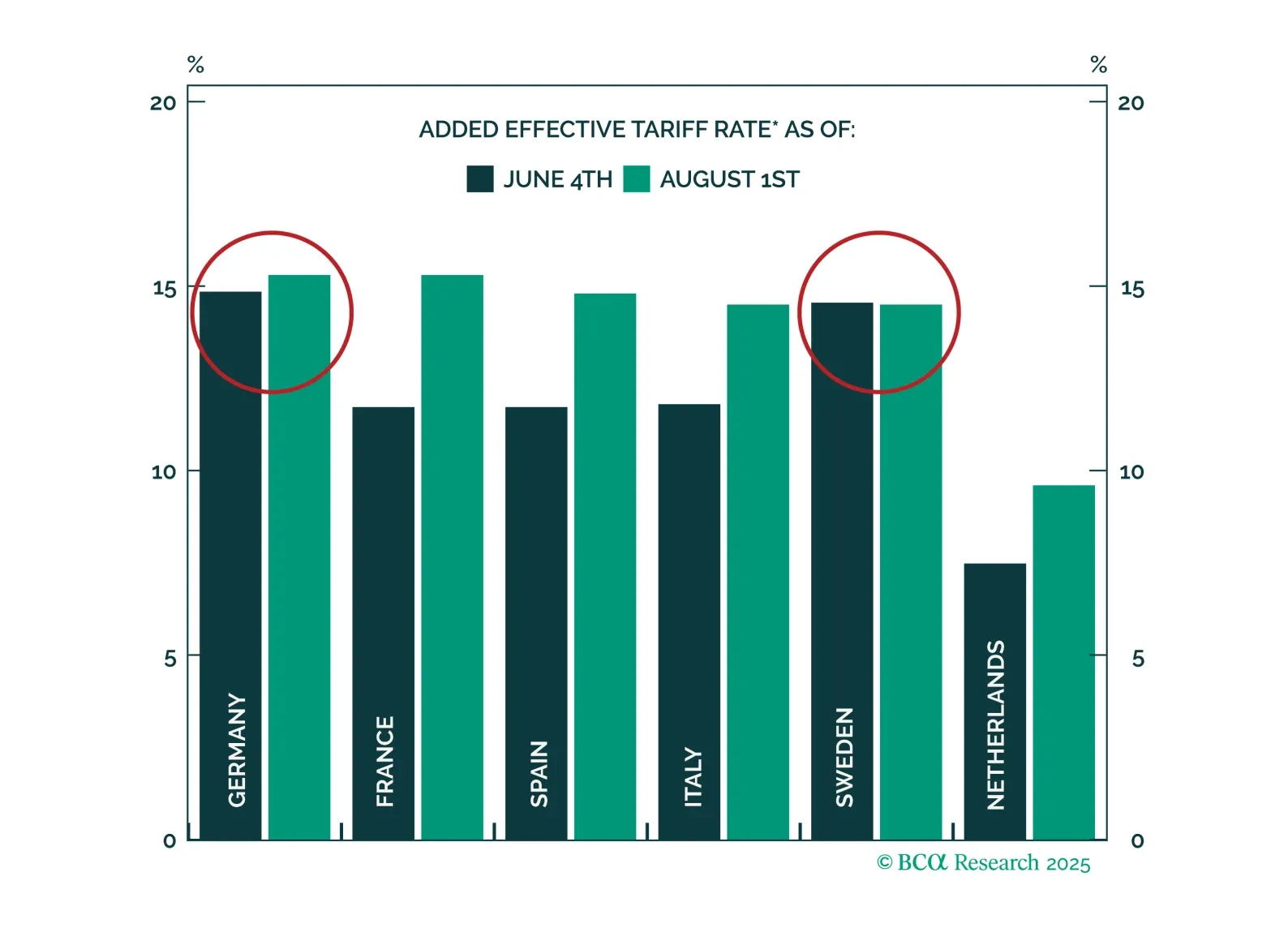

US tariffs will not derail the low-inflation economic recovery underway in the Euro Area. Investors should overweight European equities, focusing on parts of the market more insulated from tariffs.