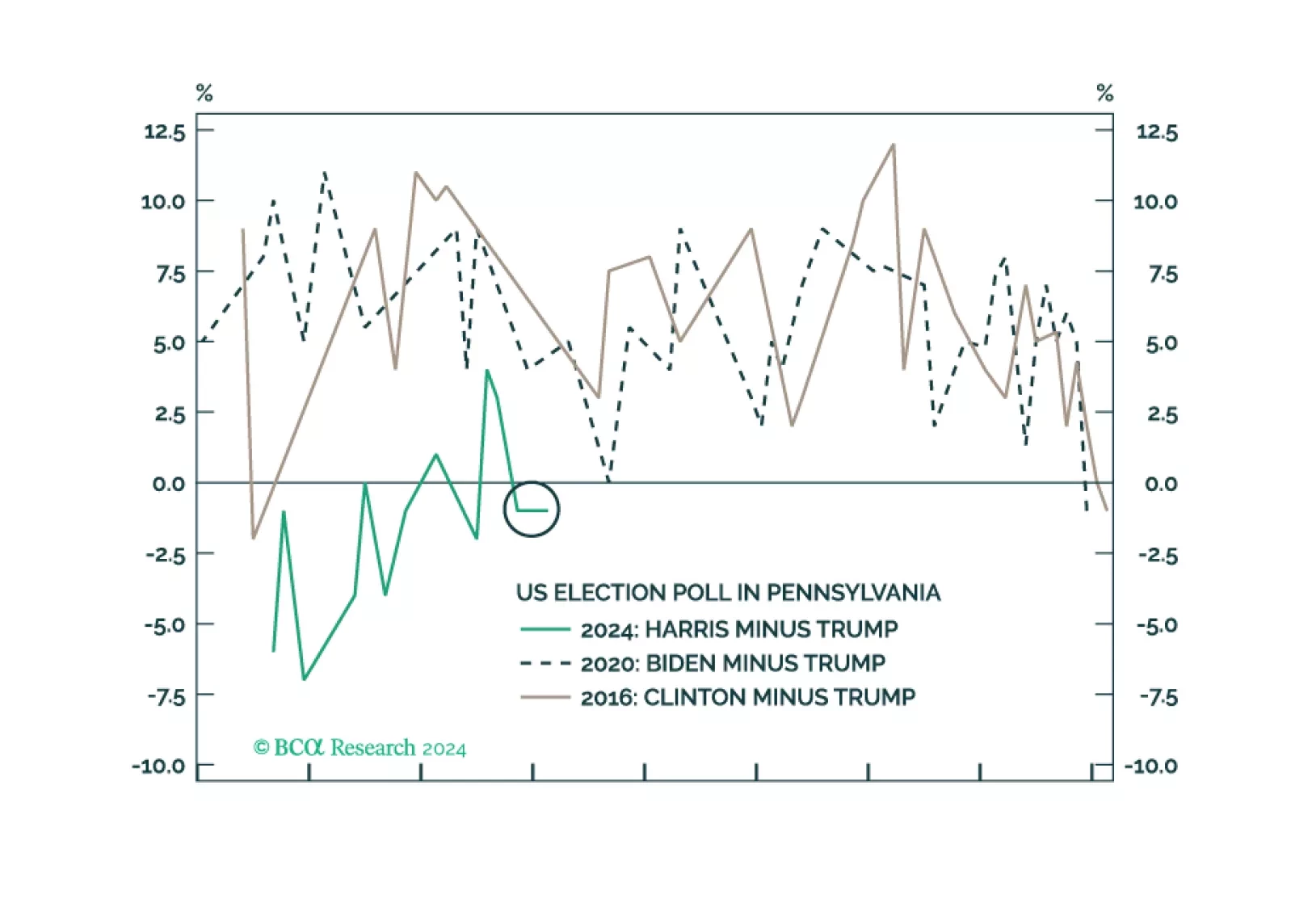

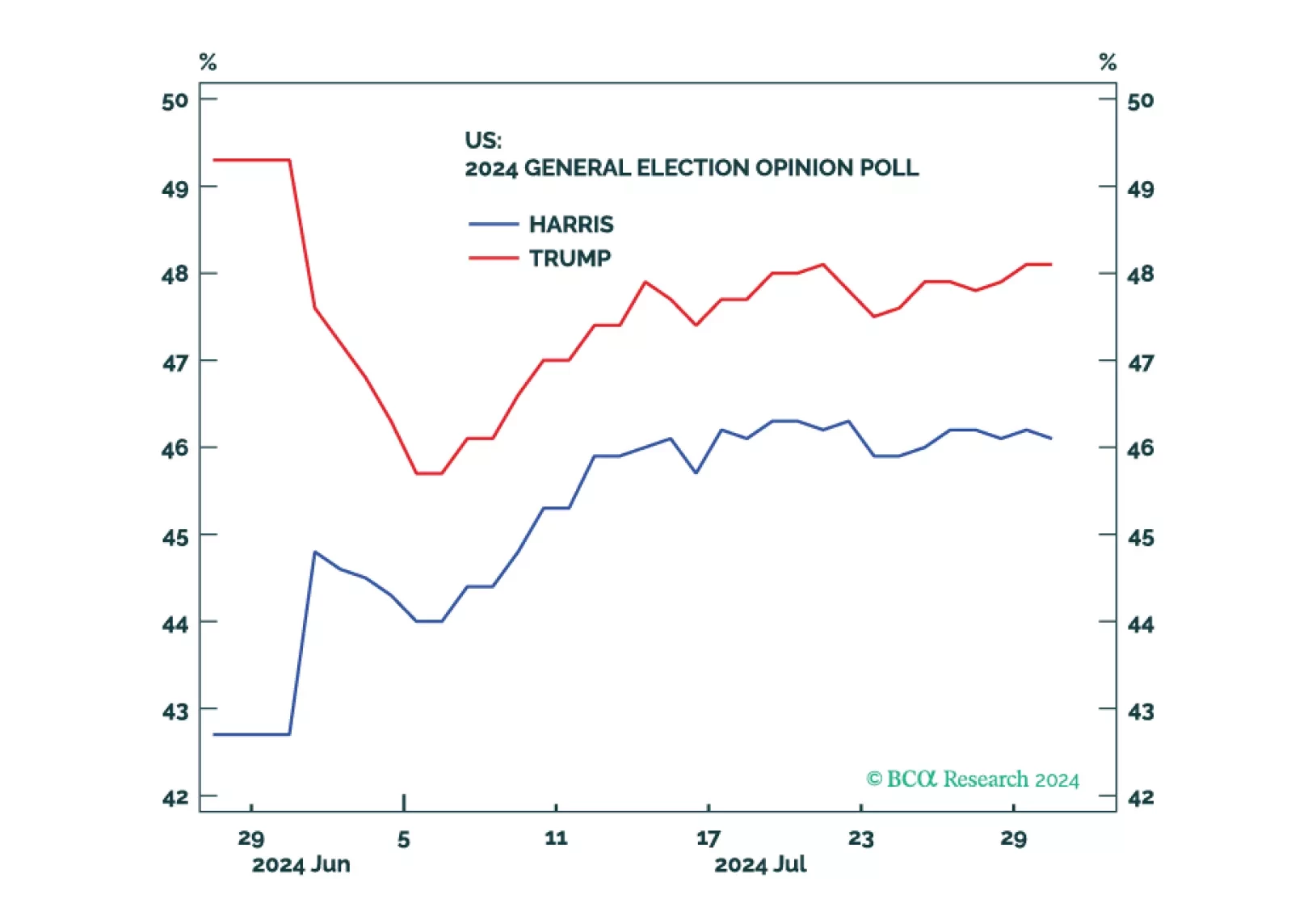

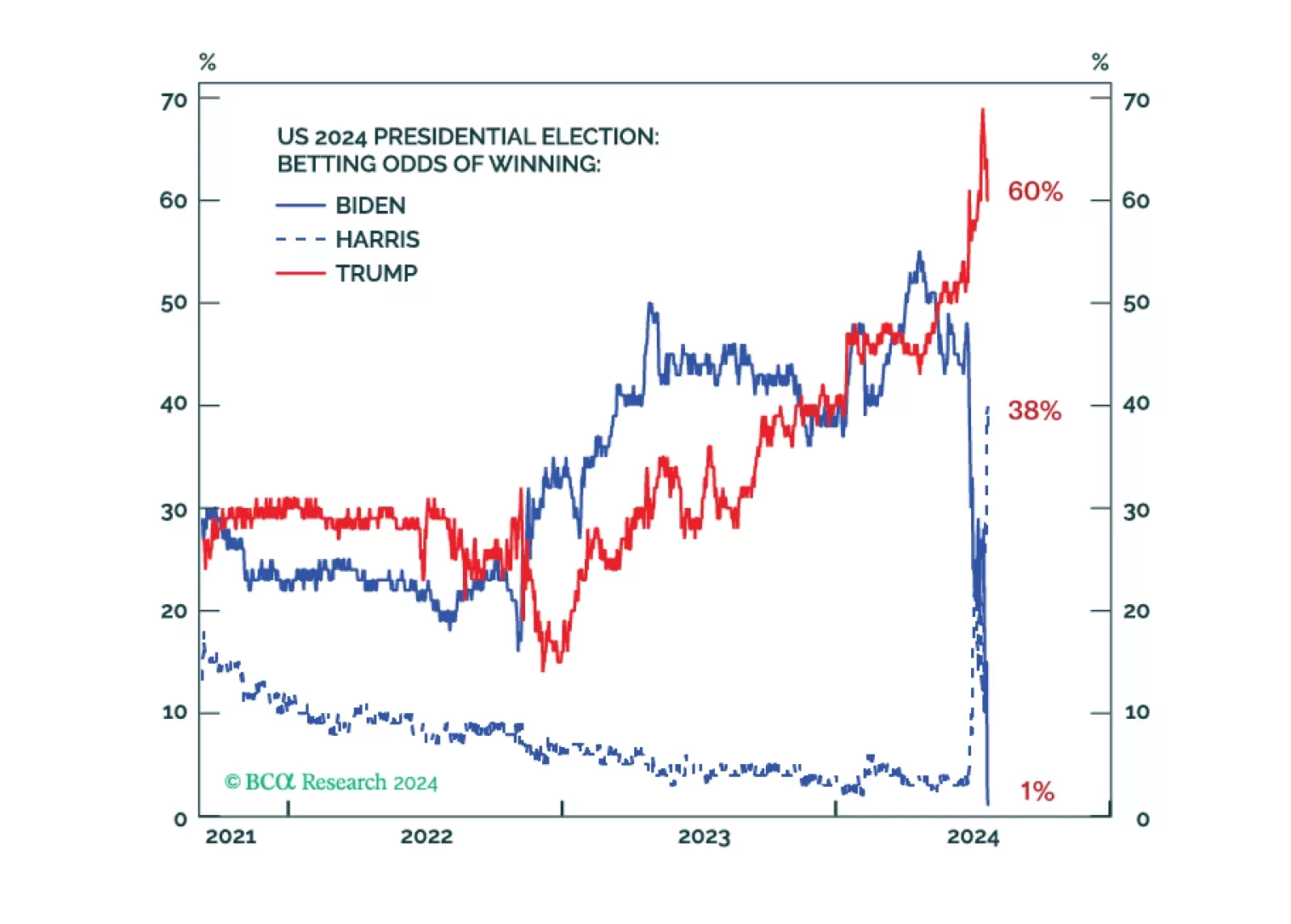

Despite the disastrous performance by former President Trump in the debate with Vice President Kamala Harris, there are still paths for him to come back to power. The economy and global instability could flare up anytime between now…

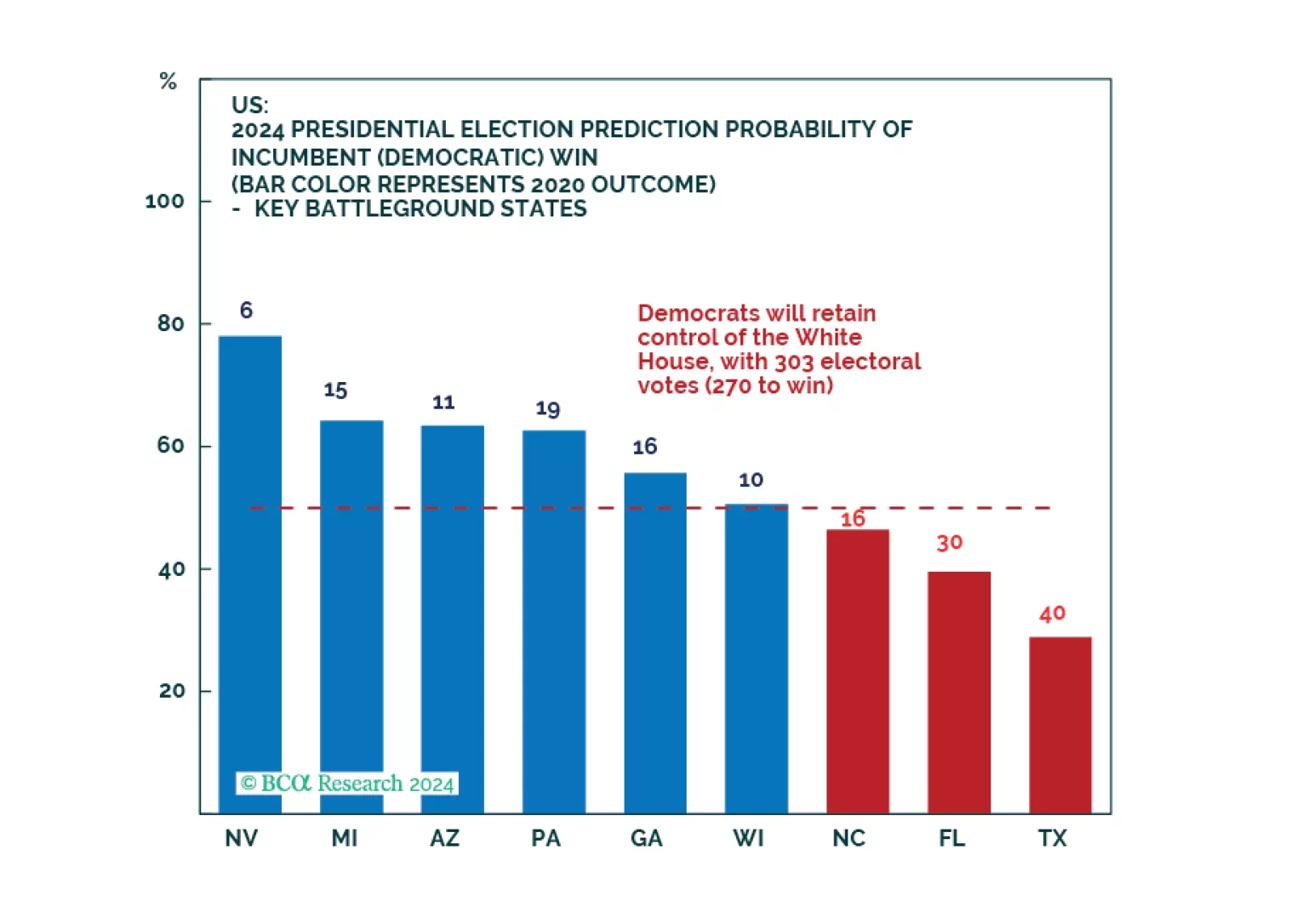

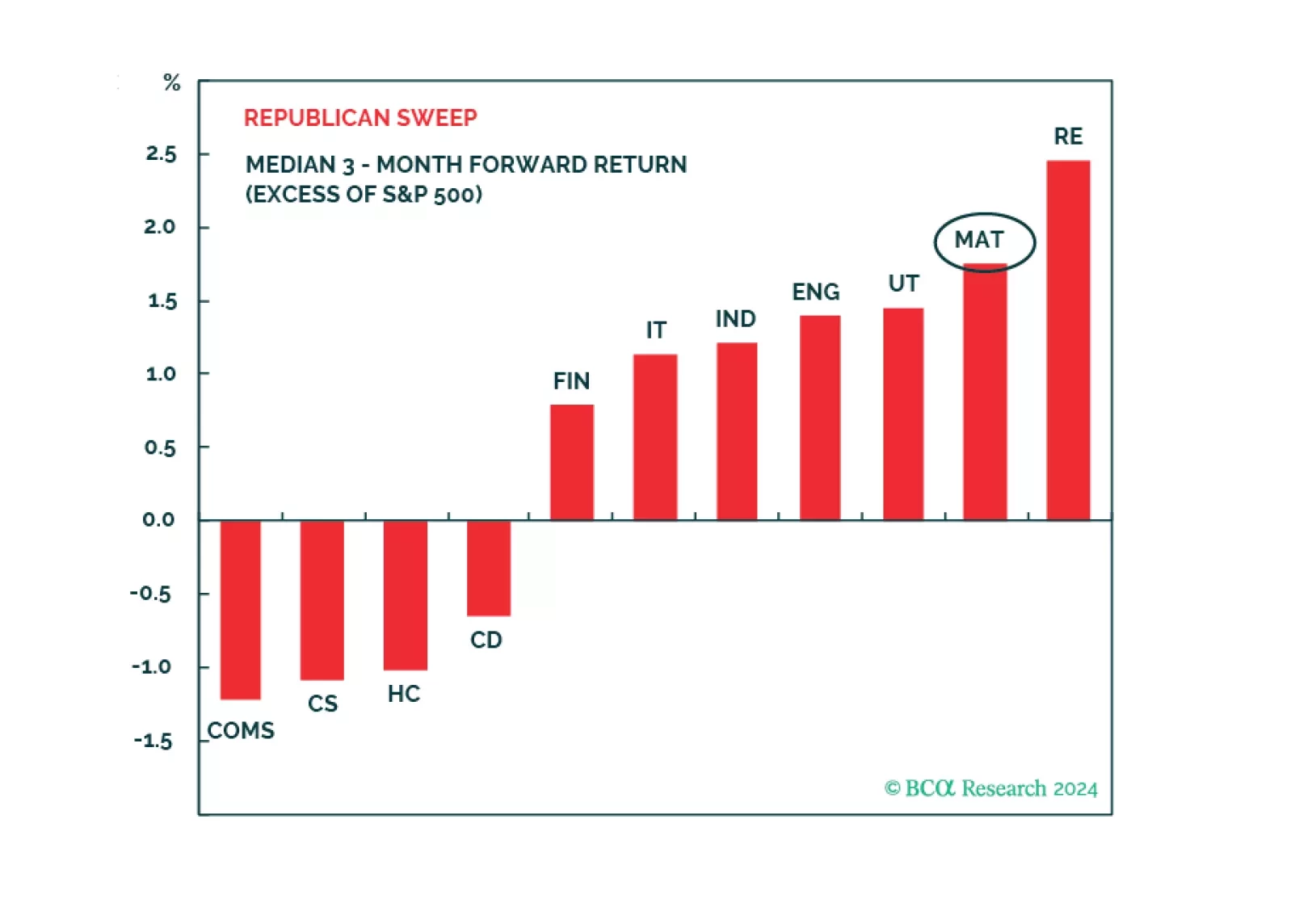

Democrats will not win a full sweep and implement drastic new tax hikes. However, our quant model still favors them to win the White House and just upgraded their odds. While we expect equity volatility around the election, investors…

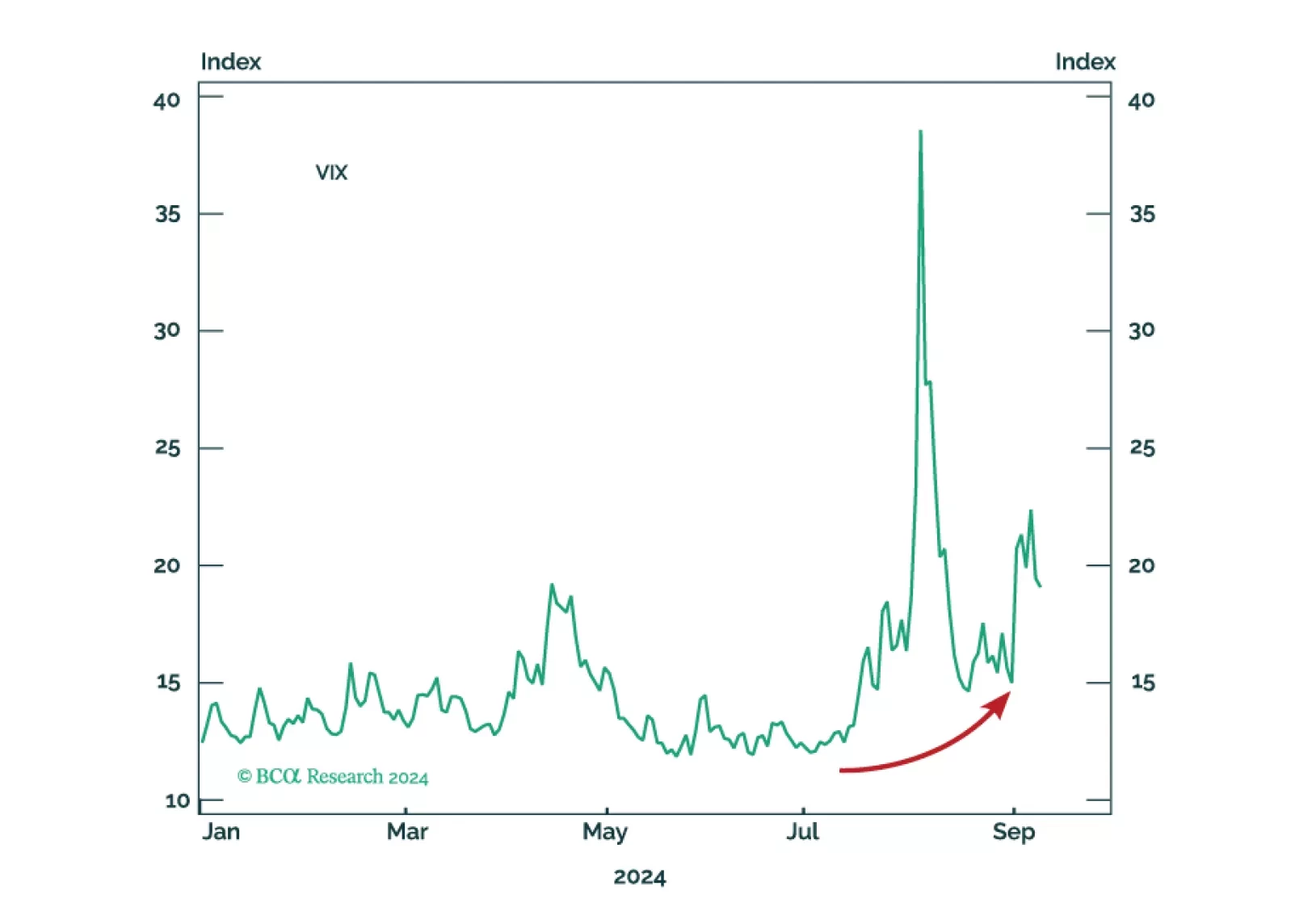

Investors should buy protection against further volatility. The shakeup in early August was a taste of things to come. The US election is a pivotal moment in modern history that will drive up uncertainty, while other countries take…

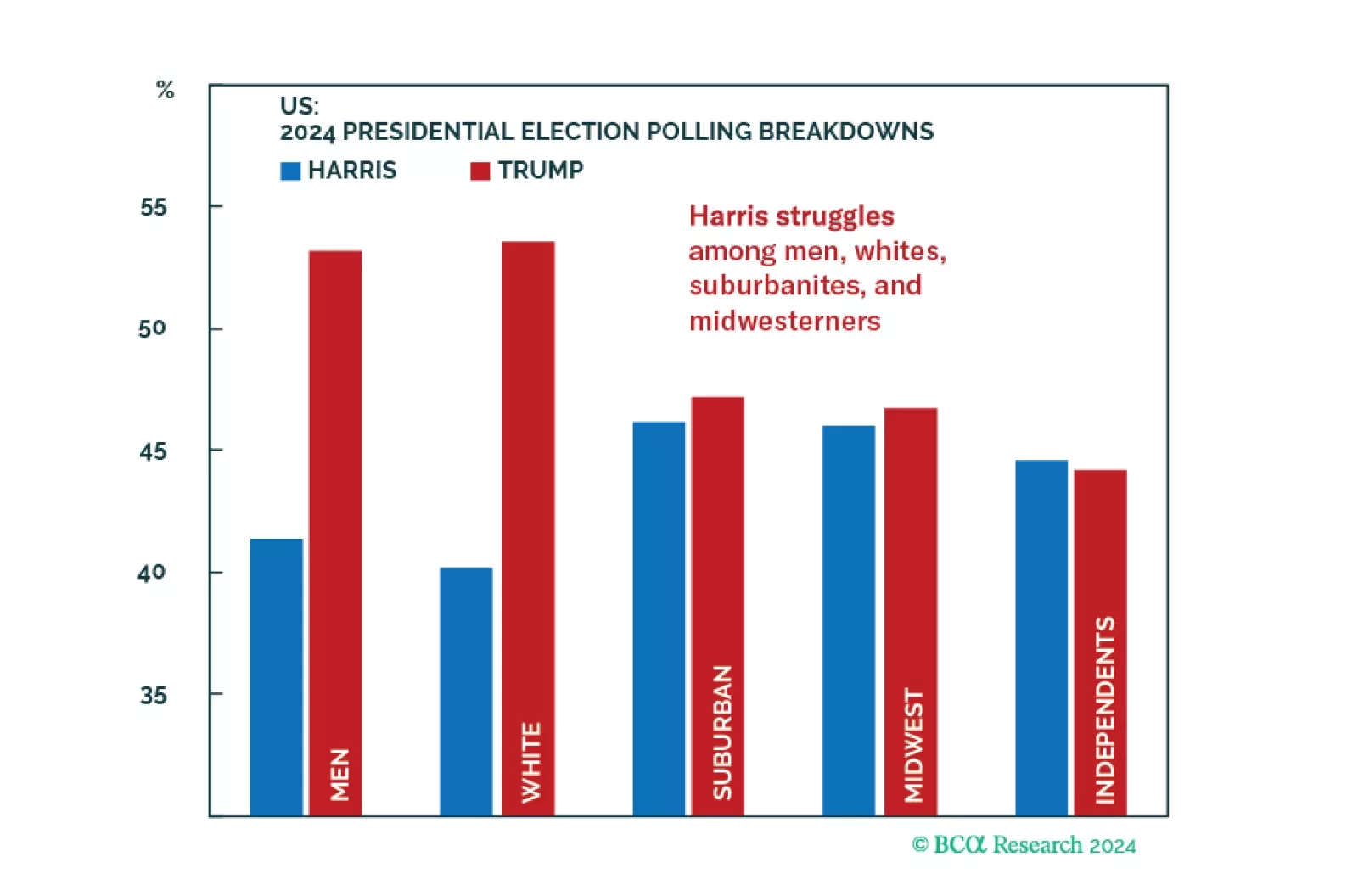

Harris picked Walz to patch up her weak side in the electorally vital Midwest. But the US election will continue to weigh on risk appetite, stocks, and high-beta assets because the odds of a single-party sweep are at least 50%,…

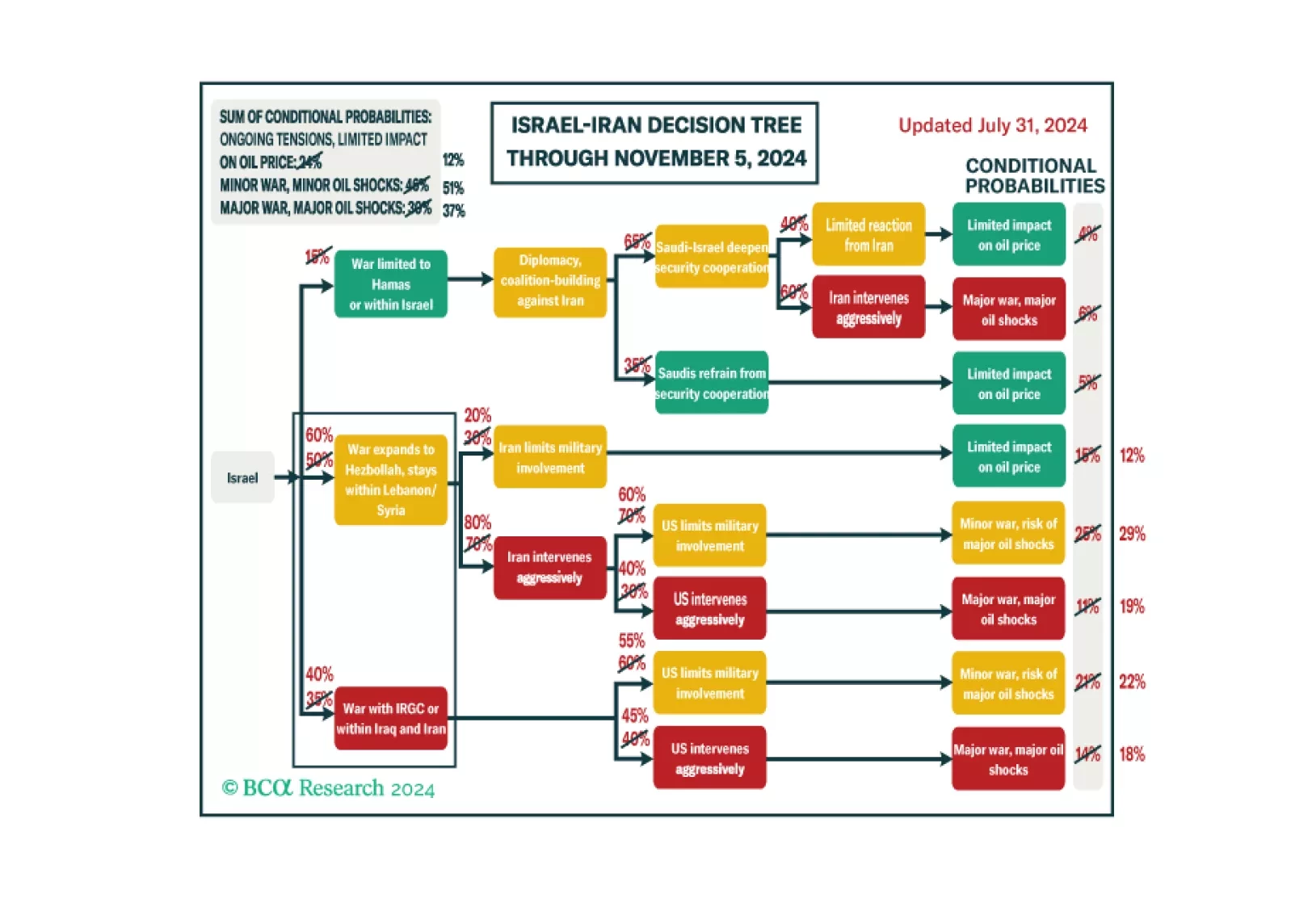

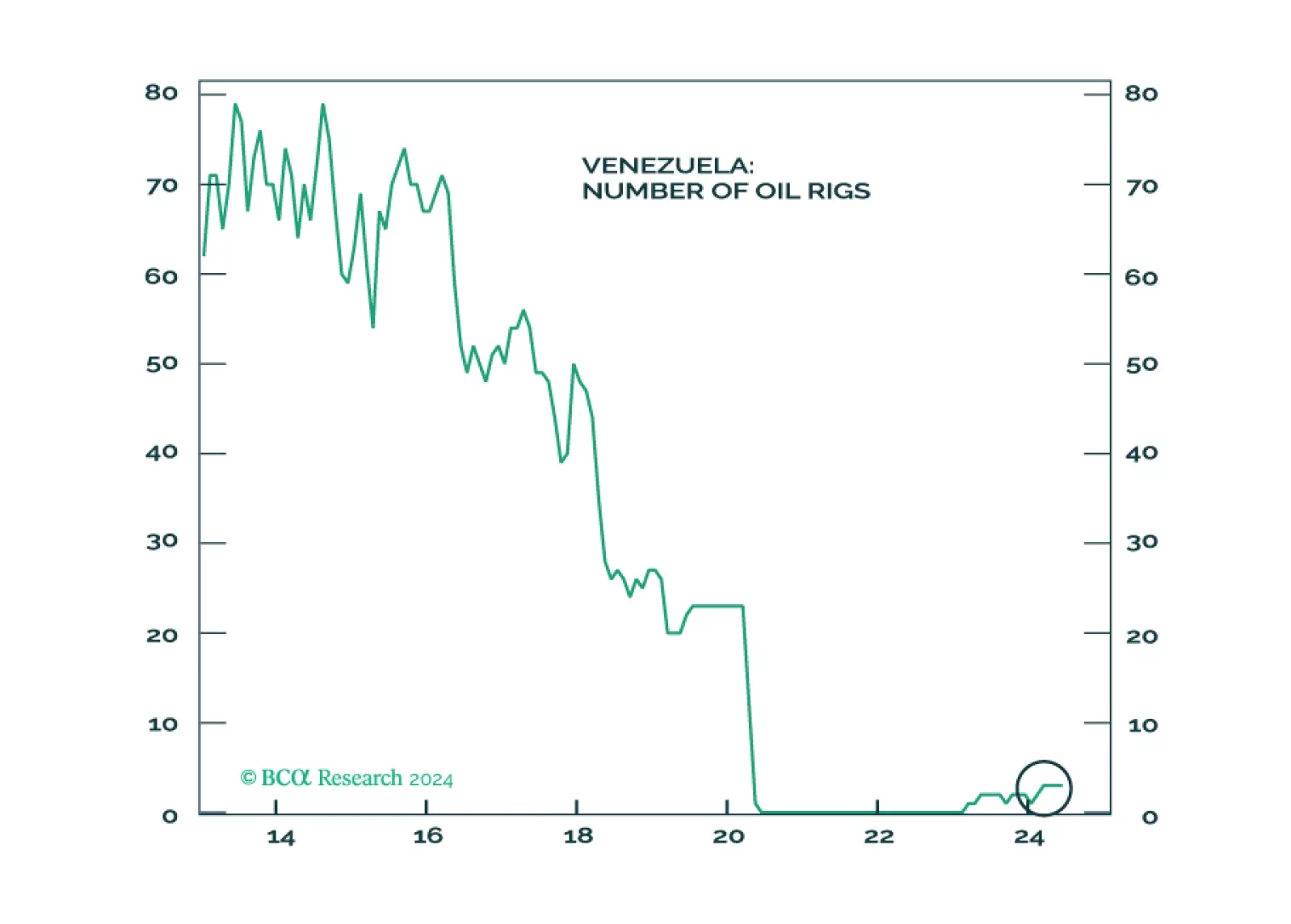

The war in the Middle East is expanding, upgrading our subjective odds of a major oil supply shock to 37% and underscoring our 60% odds of Republican victory in November. Volatility should spike again as investors contemplate the…

Republicans are favored but the election is still competitive. Equities, corporate credit, and cyclical sectors will fall until policy uncertainty is reduced.

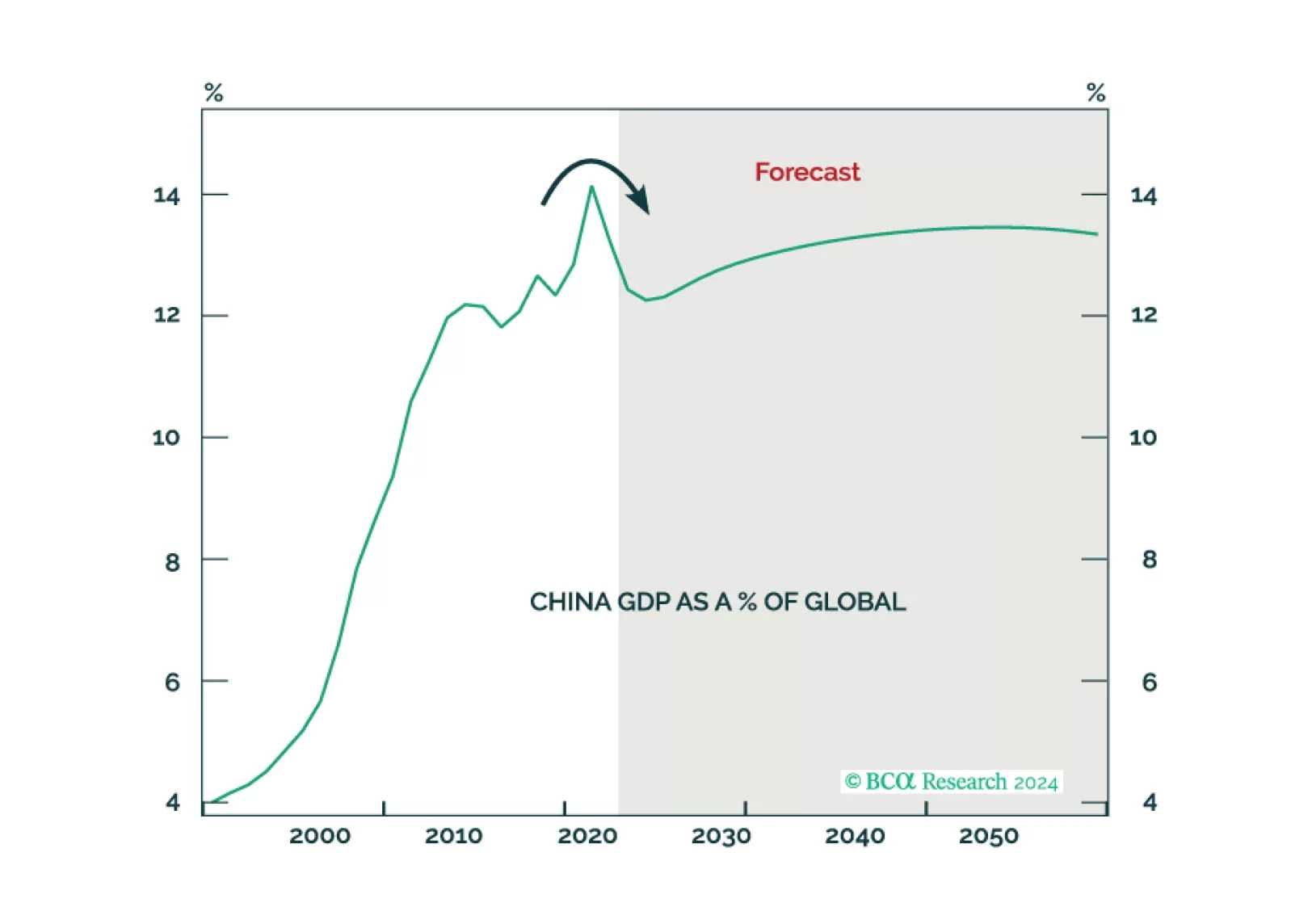

Investors should focus on growth concerns rather than the “Trump trade.” Bond yields will fall in the short run due to cyclically disinflationary economic slowdown, rather than rise in anticipation of a Republican full sweep and…