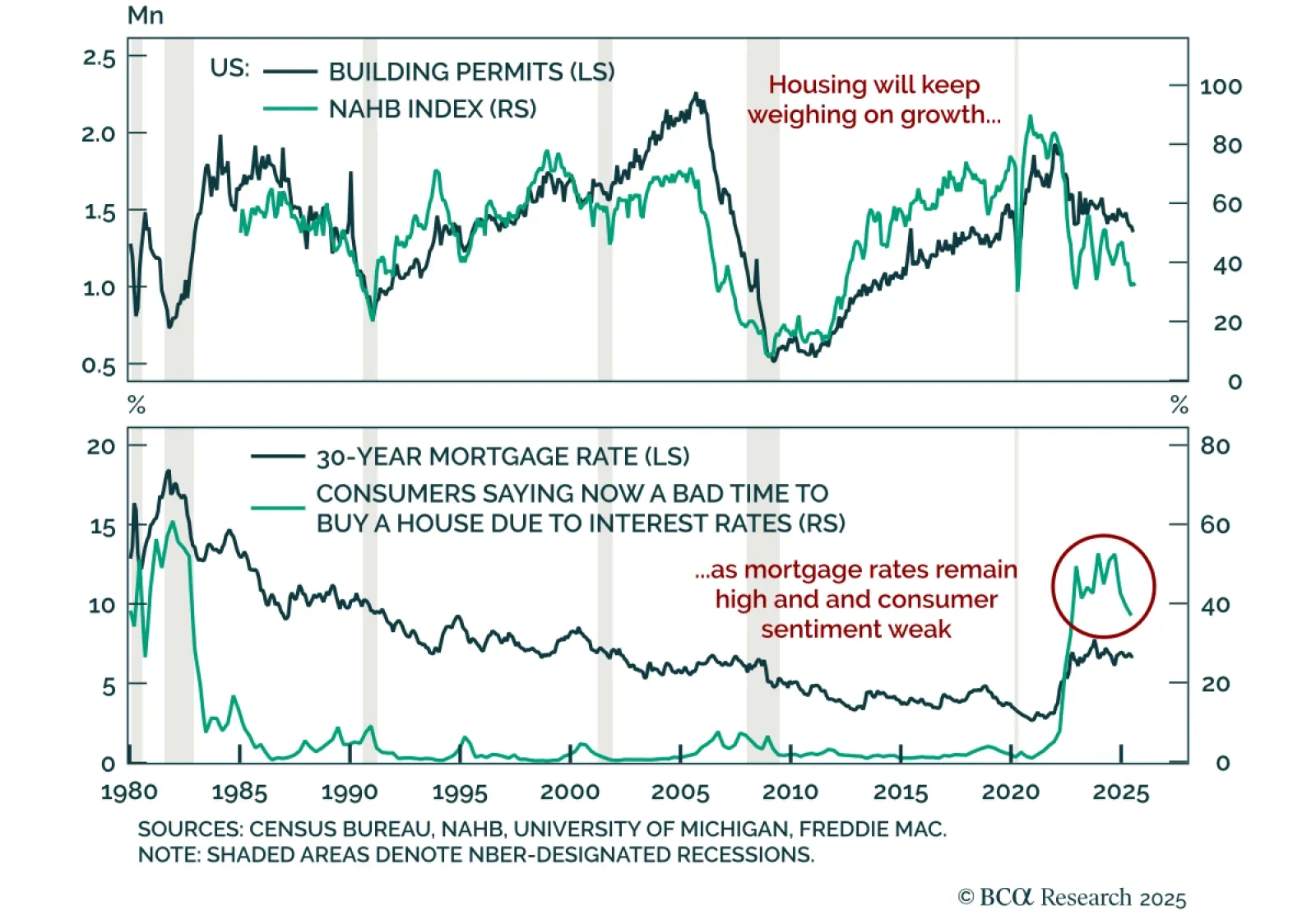

US housing data remain weak, reinforcing a fragile growth backdrop and the need for equity downside protection. July housing starts rose 5.2% m/m (annualized), but building permits fell 2.8% following a small June decline. The…

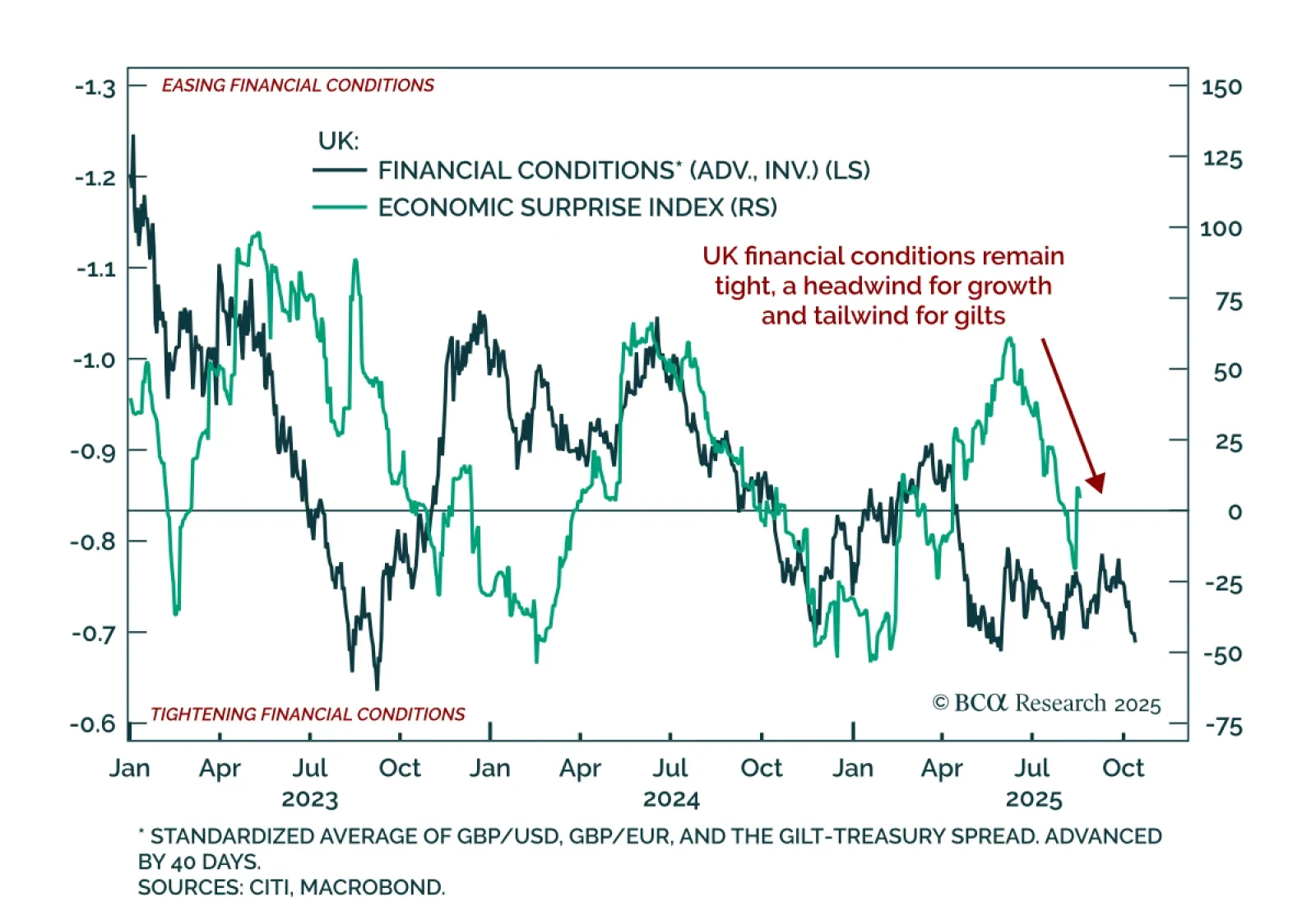

UK data momentum is fading, keeping Gilts attractive and GBP vulnerable. At 5.60%, 30-year Gilts trade at their highest yields since the late 1990s, reflecting persistent pressure on the long end across DMs. The Bank of England…

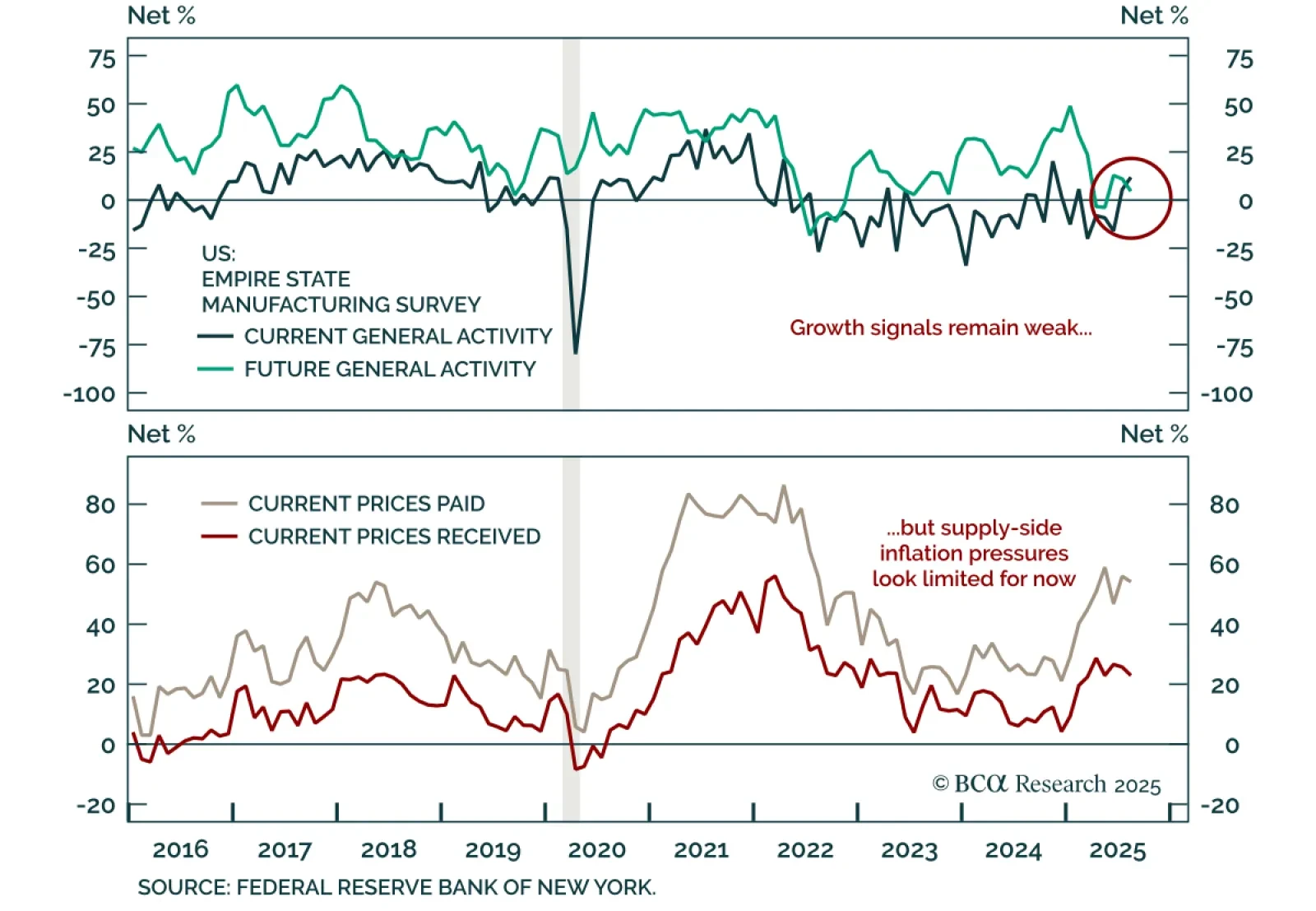

The surprisingly positive August Empire State Manufacturing survey conceals growth headwinds. The headline index rose to 11.9 in August from 5.5 in July, well above estimates. But the report showed a split between current…

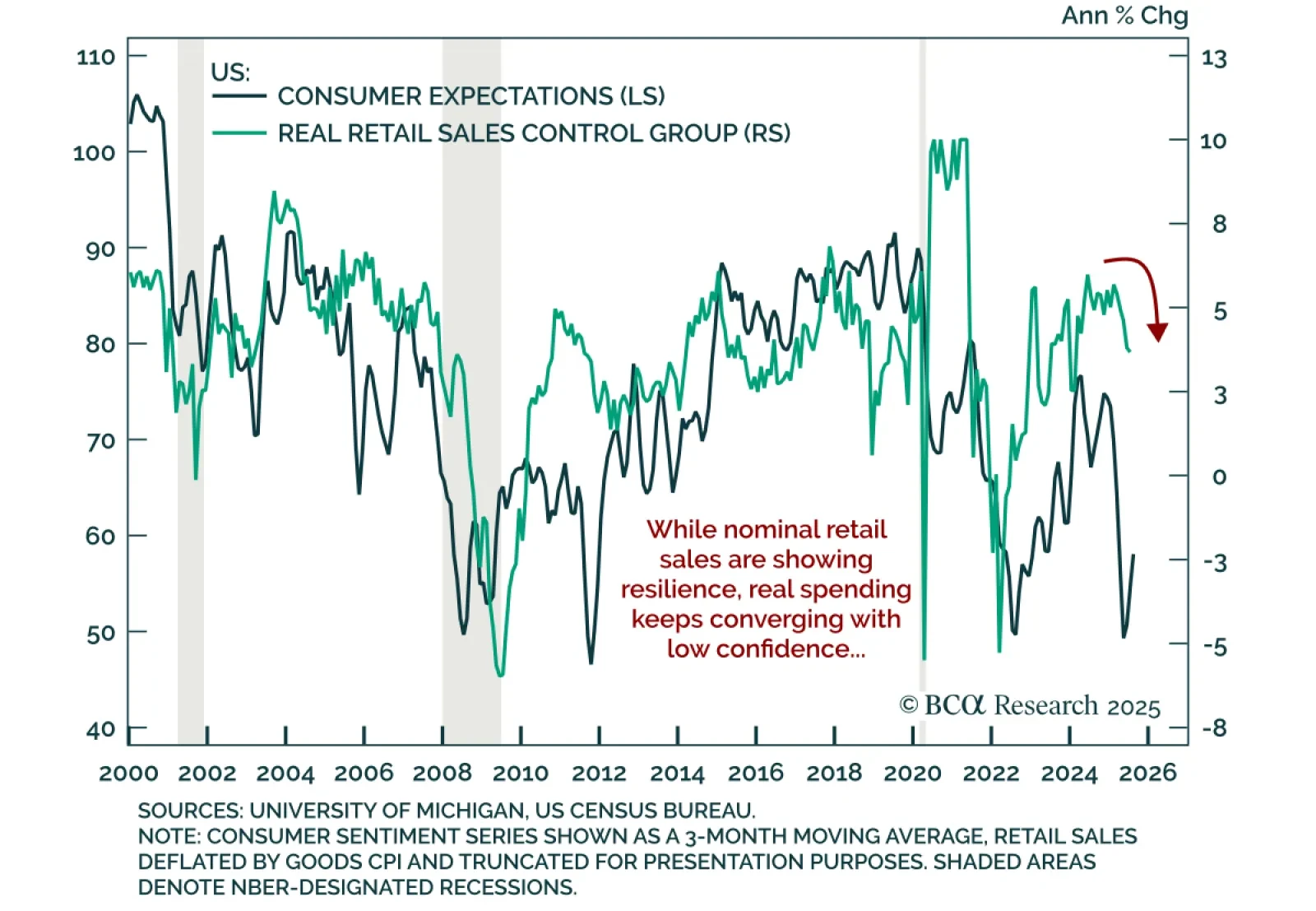

Retail sales and consumer sentiment data point to slowing underlying momentum despite headline resilience. Retail sales rose 0.5% m/m in July, below estimates and decelerating from 0.9% in June. The control group beat estimates…

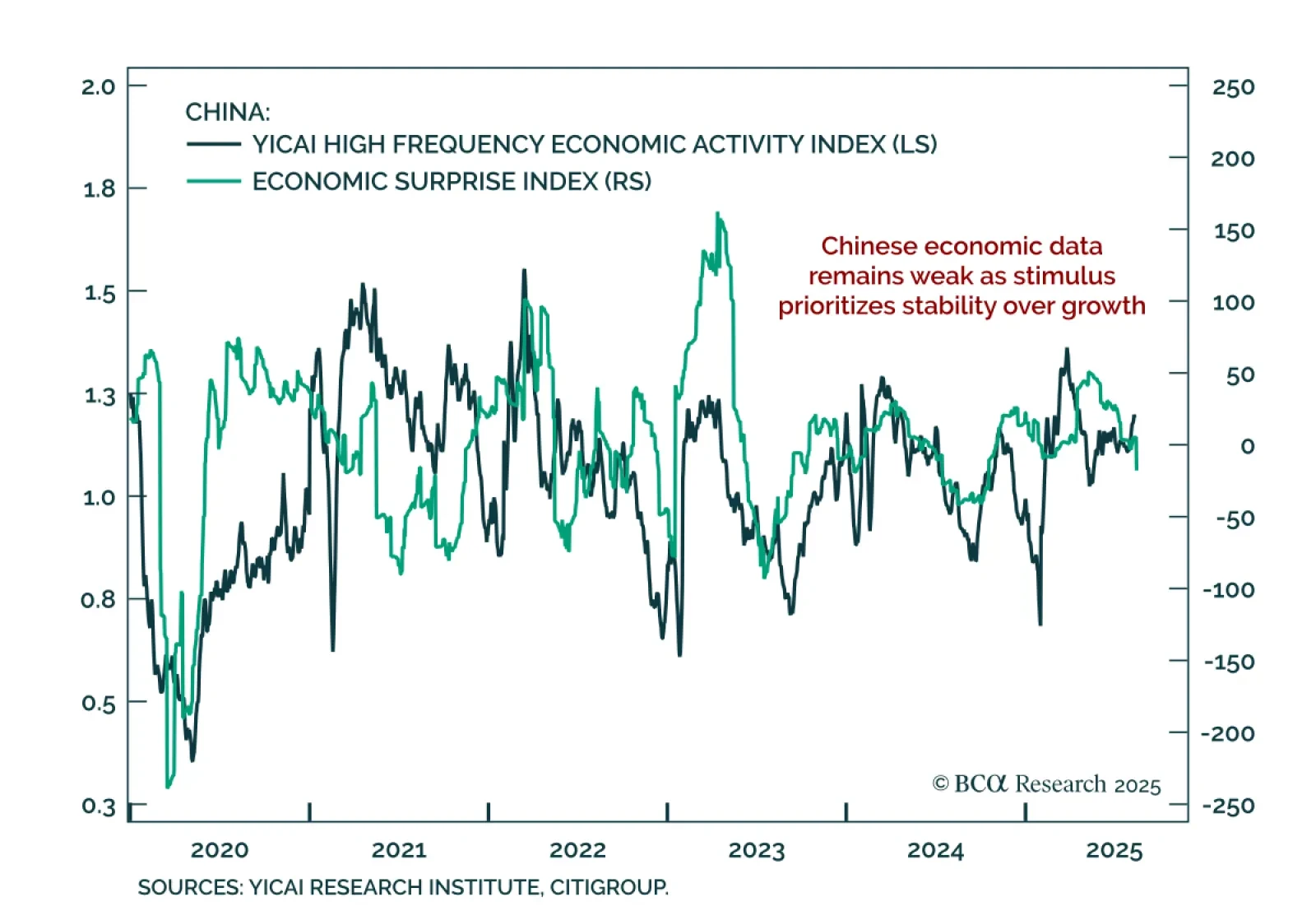

July data confirm China’s weak growth, with no near-term shift toward meaningful stimulus. New home prices fell 0.31% m/m, retail sales slowed to 3.7% y/y from 4.8%, and industrial production eased. Flooding in July disrupted…

The cost of tariffs is falling on the US consumer, not foreign exporters or US firms.

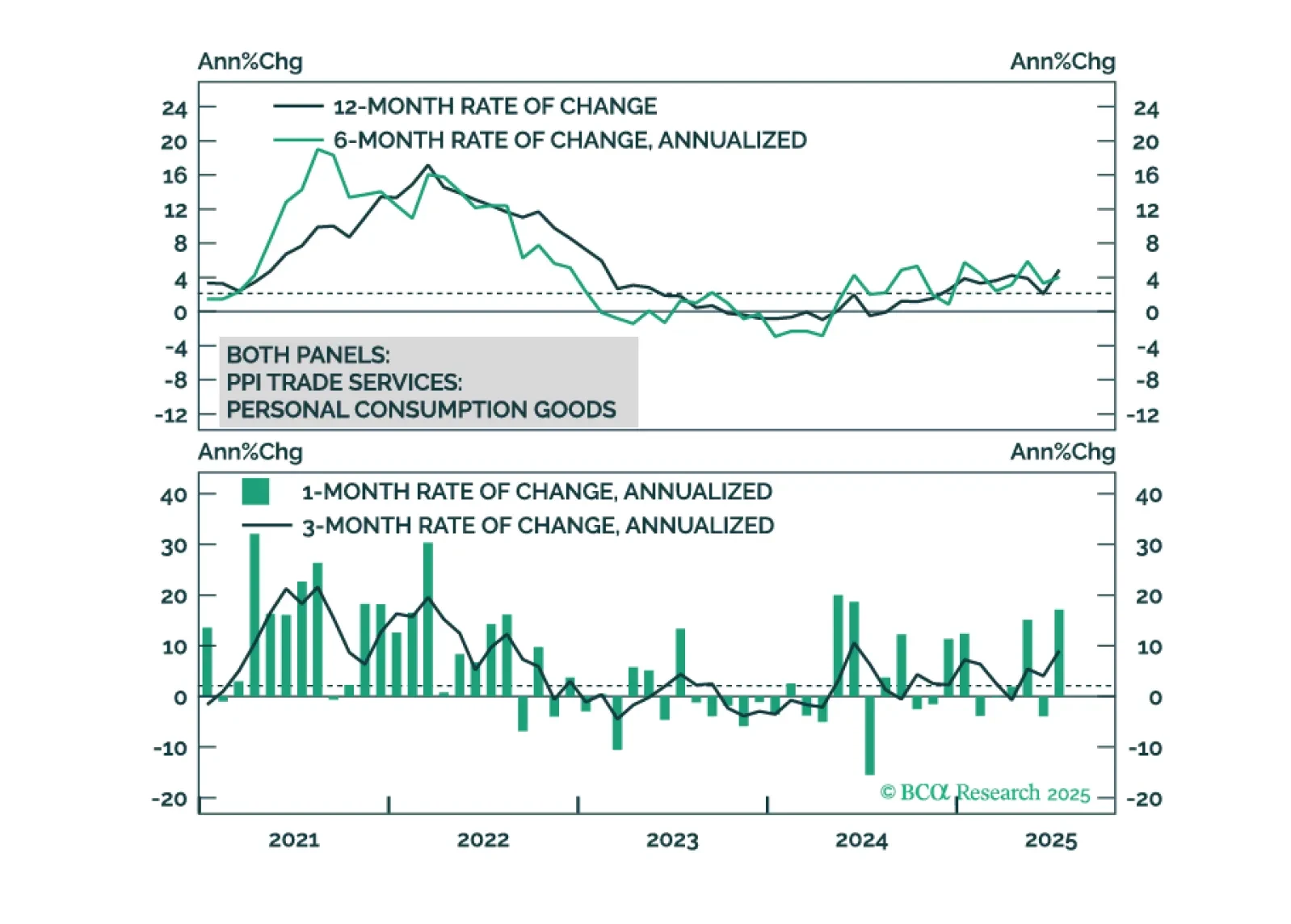

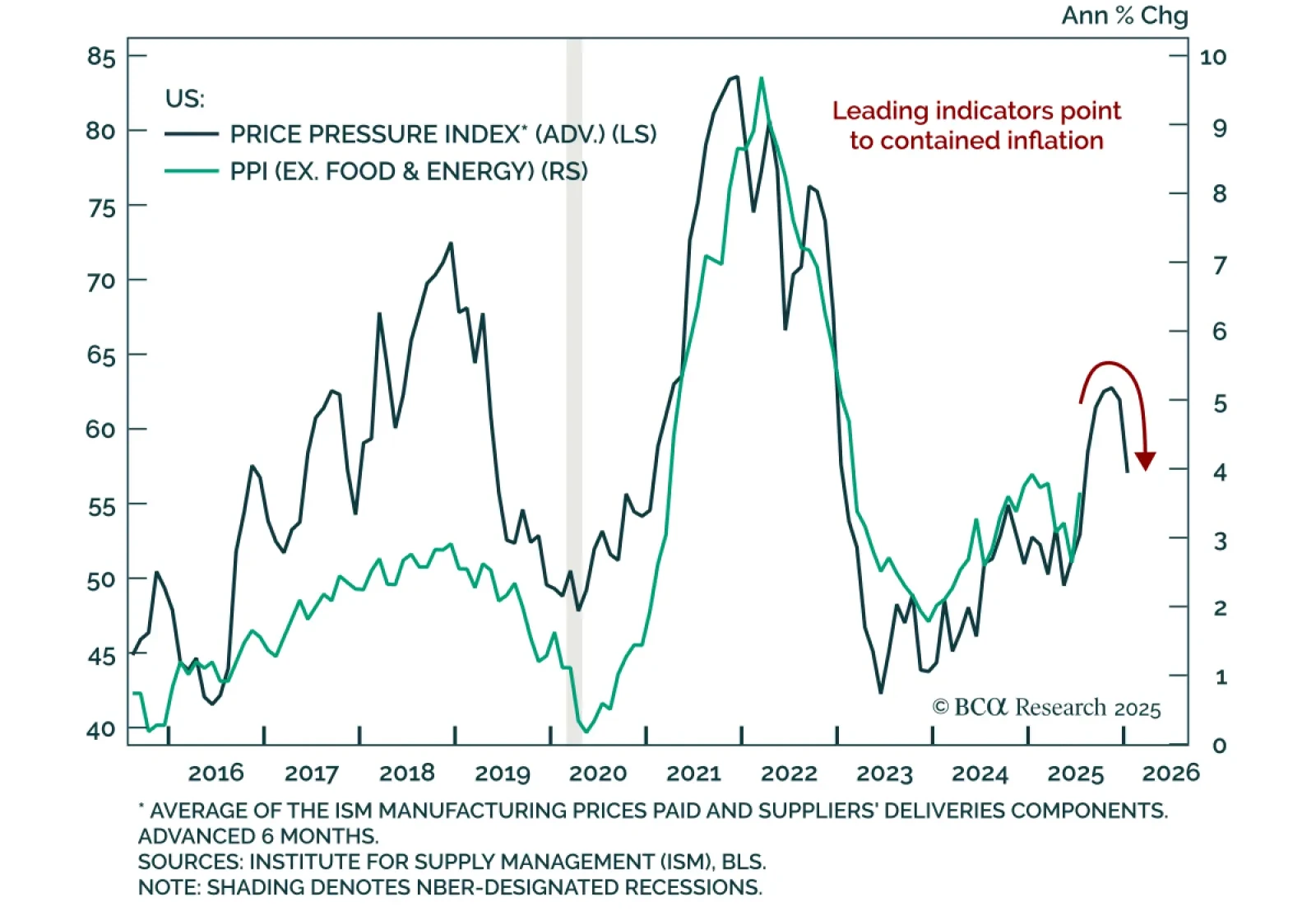

July PPI surprised sharply to the upside, but inflation pressures are likely to remain limited. Headline PPI rose 0.9% m/m (3.3% y/y) in July from 0.0% m/m (2.3% y/y) in June, while core PPI gained 0.6% m/m (2.8% y/y). PPI components…

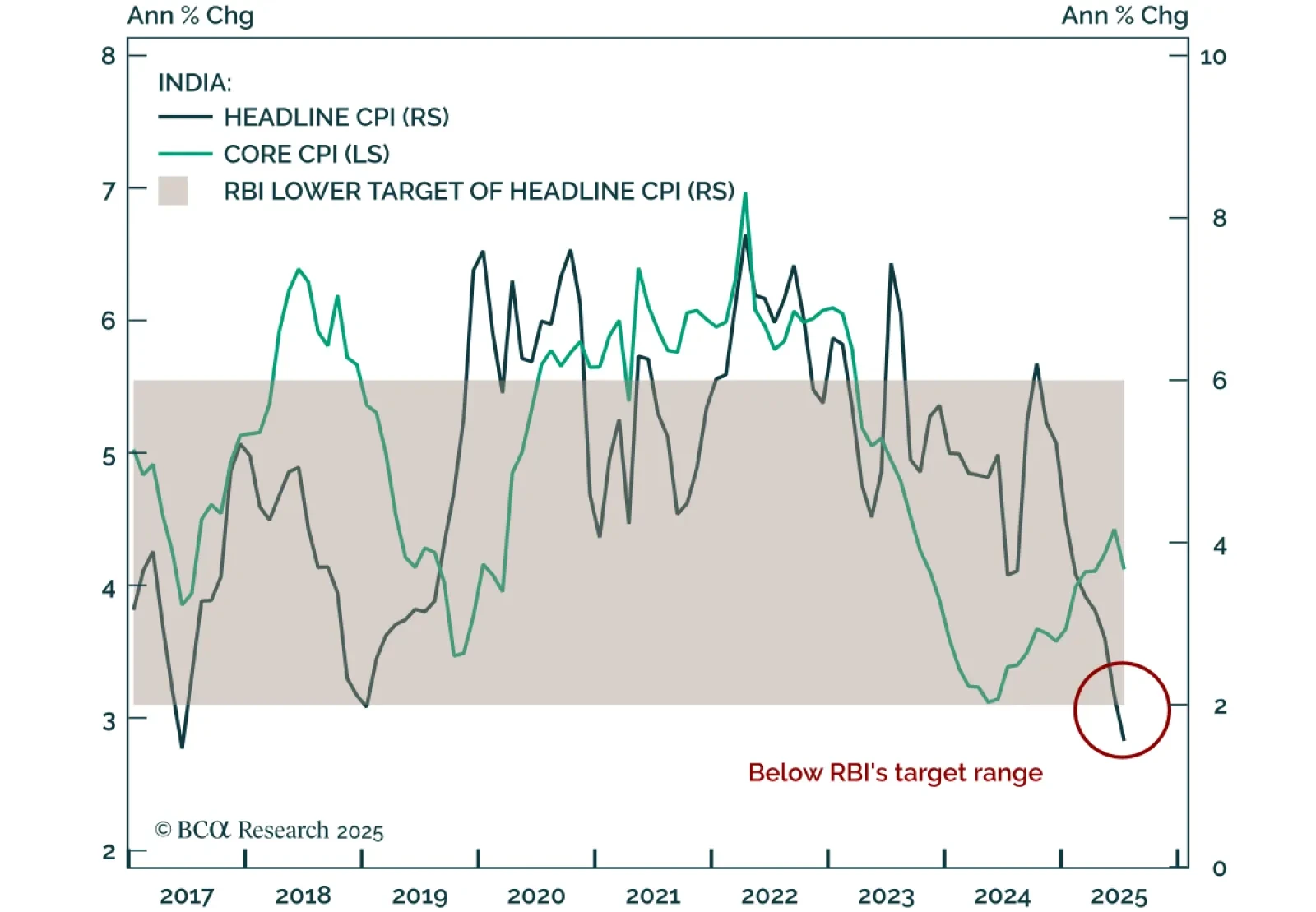

India’s sharp CPI undershoot will bring forward rate cuts, supporting a long on local bonds. Headline CPI fell to 1.55%, well below the RBI’s 2-6% target range, pointing to earlier and deeper easing than markets price. Our…

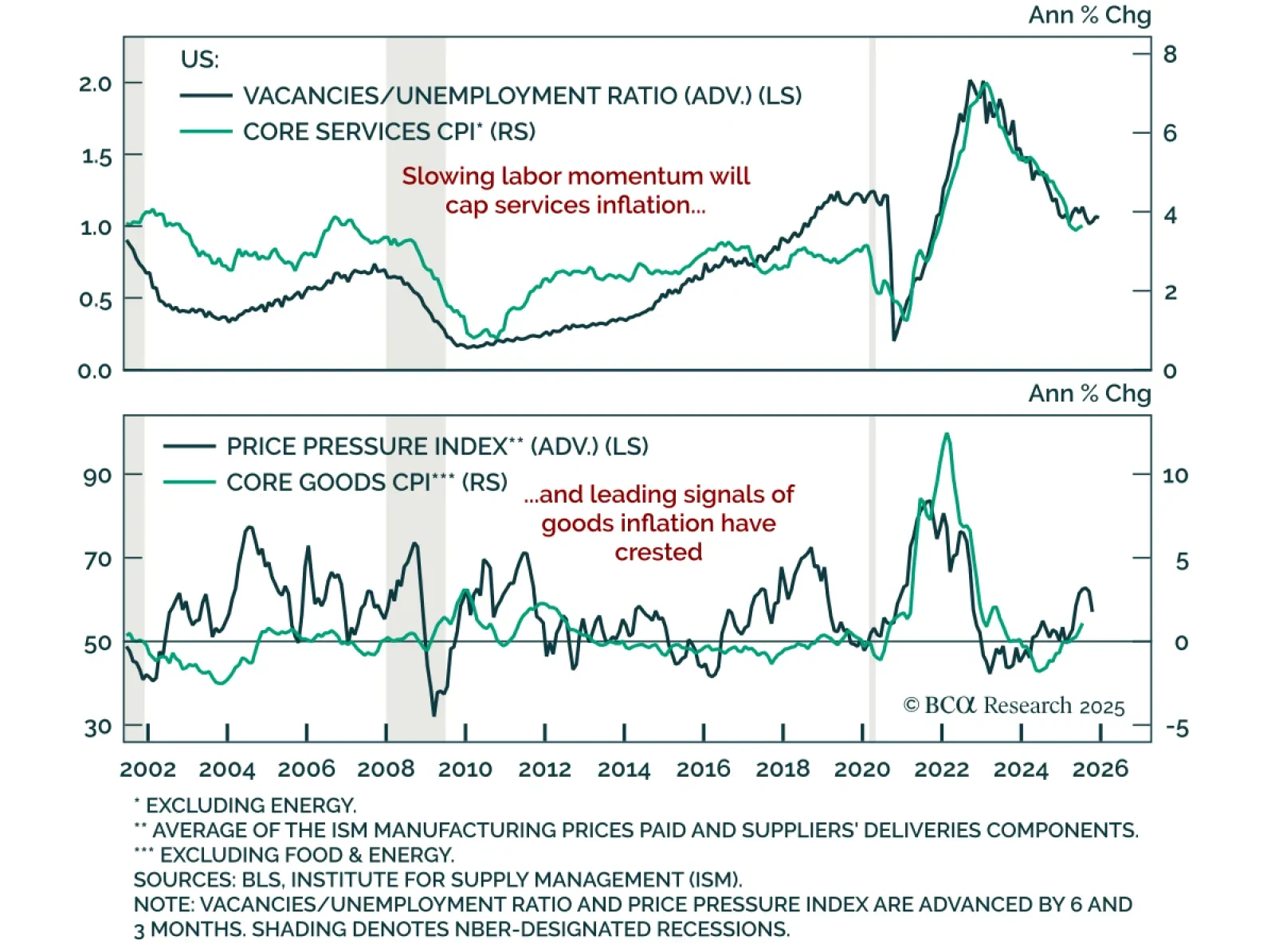

July US CPI met expectations as leading indicators point to disinflation, supporting our long duration stance and preference for 2s5s steepeners. Headline CPI rose 0.2% m/m (2.7% y/y), while core increased 0.3% m/m and…

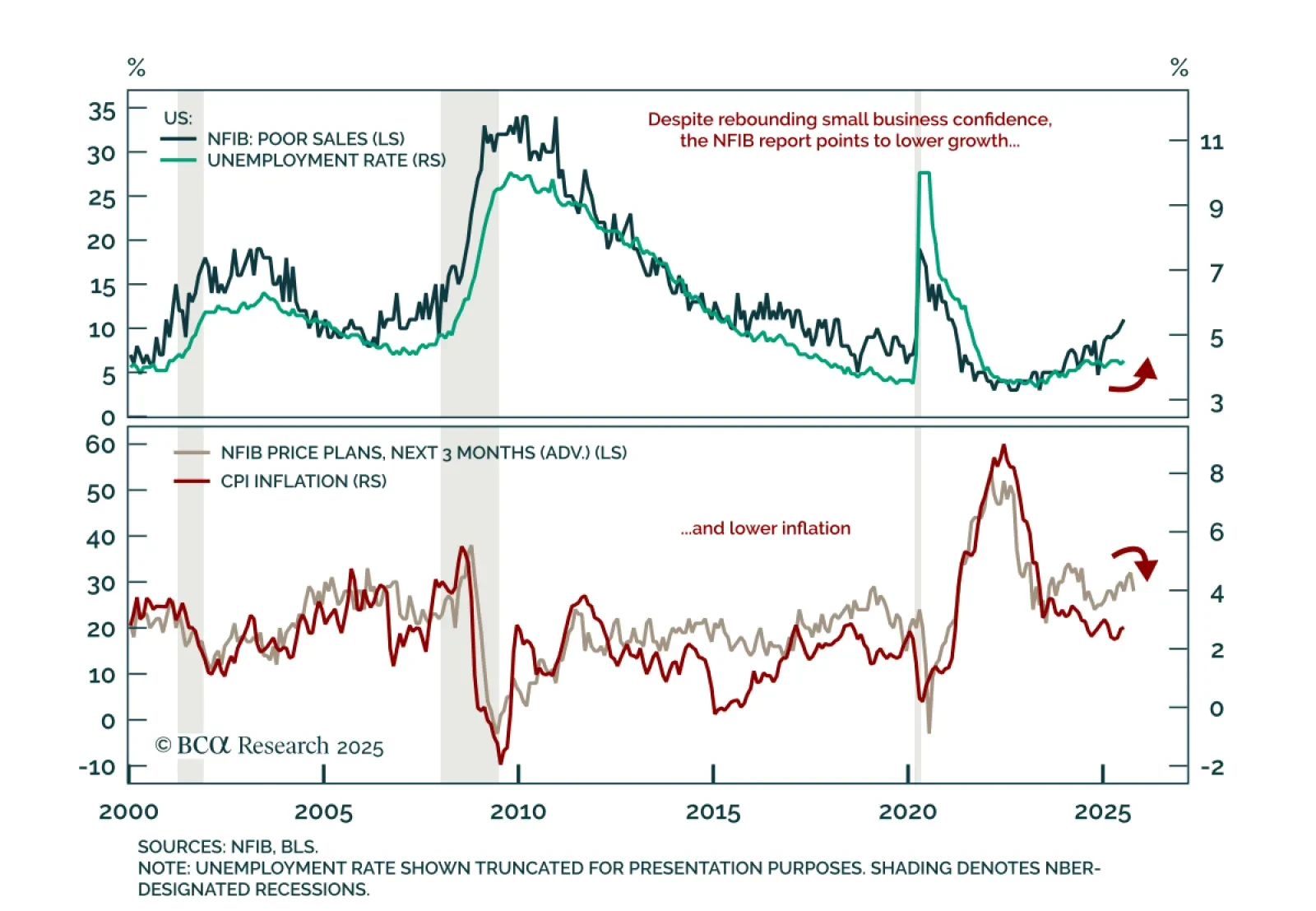

The July NFIB survey showed a rebound in expectations, but underlying weakness reinforces left-tail risks and supports a moderate risk-off allocation. The headline index rose to 100.3, a five-month high, but remains below…